“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves” – Peter Lynch

Another Down Week for Markets

The market retreat continued this week, with the TSX and S&P 500 finishing the week down 3.76% and 3.95% respectively. The total drop from the summer peaks are about 10.2% and 9.5%, respectively.

We have written extensively on this subject the past few weeks. If you have not already done so, we encourage you to read the following entries:

Longest bull market: Where do we go from here?

How to Protect against a Correction

Negative returns are never pleasant, but they inevitably happen. Historically speaking, the S&P 500 experiences an average of three 5% declines per year. Furthermore, even though the S&P 500 had a positive year 74% of the time, it also experienced an average intra-year decline of 14% (please refer to the Drama is Constant article).

The American market has seen 57 declines of 10% of more since 1946, or about 1 every 15 months. It has recovered from each one of these and set new highs. The S&P 500 is currently down about 10% since its September peak. The status of this pullback can be best described as average.

Many studies have also highlighted the futility or trying to time the peaks and troughs of the market. The best way to weather a correction is to simply ride it out (and buy the dips).

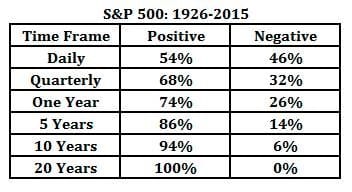

We leave you with one simple table this week:

The chart above reminds us why a long-term approach is more sensible. In the past 90 years on the S&P 500, on any given day the markets had about a 50/50 chance of closing up or down. In any 3-month period, those odds improved to 66/34. In any one year period, markets finished up 74% of the time. For any 10 or 20 year window, markets were up 94% or 100% of the time. The message is simple: anything can happen in a day, in a quarter, or in a year, but during longer time periods the markets invariably yield positive results.

Bank of Canada Raises Key Rate to 1.75%

On Wednesday, the Bank of Canada hiked its rate 0.25% up to 1.75%. This is the fifth such hike since July 2017 (when the rate first jumped from 0.50% to 0.75%) and more hikes are expected throughout the remainder of 2018 and into 2019.

The bank dropped its recent pledge to take a “gradual” or “cautious” approach to rate increases. The go-slow message has been a fixture of the bank’s statements for the past year. Its removal now suggests the bank could break with its recent pattern of hiking on every second interest rate announcement date and will now consider moving more frequently.

Prime rates at your local bank are currently around 4.00% and are projected to be 4.50 – 5.00% by the end of 2019.

Canada Post Strike

On Monday, The Canadian Union of Postal Workers (CUPW) issued a strike notice and Canada Post began rotating strikes. Strike action will be isolated to select areas for a period of 24 hours and after the 24-hour period, service will resume. Canada Post will continue regular service for all other unaffected areas during this time.

If you currently receive statement by mail, you may experience a short delay. You may wish to consider switch to e-statement delivery of you Fundex statement. You can opt for e-delivery in your Fundex Wealthview account settings or by e-mailing JoAnne at [email protected].