“The individual investor should act consistently as an investor and not as a speculator.” – Ben Graham

Happy New Year! We hope you enjoyed the holidays.

Here are the returns of the major indexes in 2018:

North America

- The TSX closed at 14,323 for the year. YTD the TSX is down -11.64%.

- The DOW closed at 23,328 for the year. YTD the DOW is down -5.63%.

- The S&P closed at 2,507 for the year. YTD the S&P is down -6.25%.

- The Nasdaq closed at 6,635 for the year. YTD the Nasdaq is down -3.88%.

- Gold closed at 1,285 for the year. YTD gold is down -1.91%.

- Oil closed at 45.83 for the year. YTD oil is down -24.15%.

- The USD/CAD closed at 0.7328 for the year. YTD the USD/CAD is down -7.86%.

Europe/Asia

- The MSCI closed at 1,885 for the year. YTD the MSCI is down -10.37%.

- The Euro Stoxx 50 closed at 3,001 for the year. YTD the Euro Stoxx 50 is down -14.36%.

- The FTSE closed at 6,728 for the year. YTD the FTSE is down -12.49%.

- The CAC closed at 4,731 for the year. YTD the CAC is down -10.95%.

- DAX closed at 10,559 for the year. YTD DAX is down -18.26%.

- Nikkei closed at 20,015 for the year. YTD Nikkei is down -12.08%.

- The Shanghai closed at 2,494 for the year. YTD the Shanghai is down -24.58%.

For North American markets, these returns don’t tell the full story. Both the TSX and S&P 500 were up in the first half of the year. The TSX peaked at 16,567 on July 12th and bottomed out at 13,780 on December 21st, for a total drawdown of 16.8%. The S&P 500 peaked at 2,929 on September 21st and bottomed out at 2,351 on December 24th, for a total drawdown of 19.7%.

Here are three positives to keep in mind about last year’s returns:

1. We are likely close to a bottom

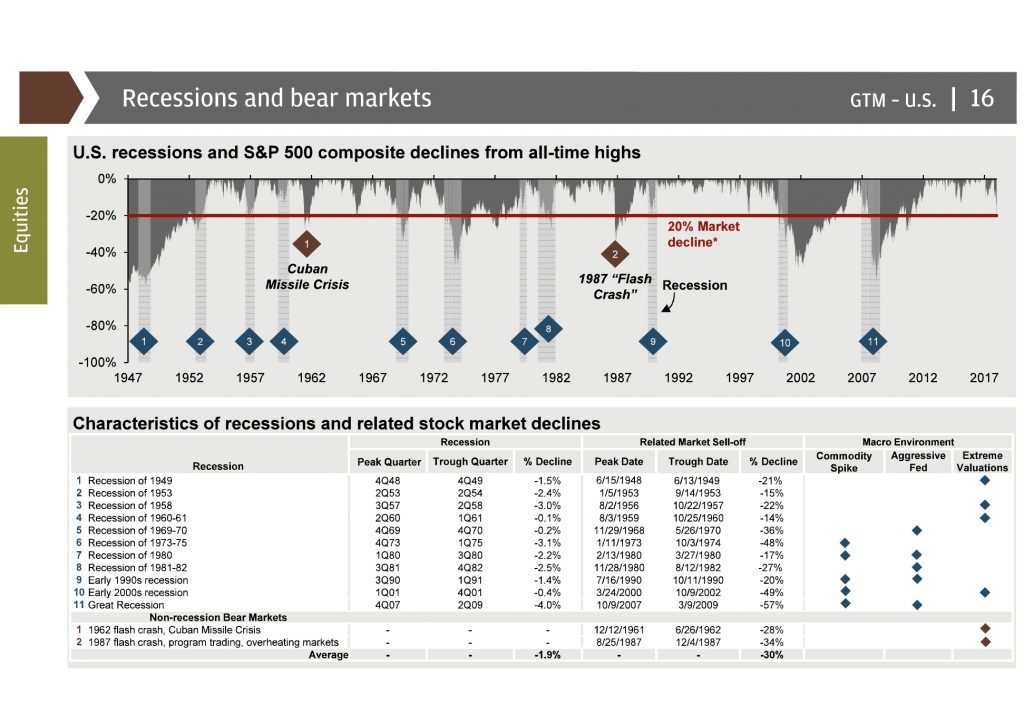

Since 1949, there have been 13 instances where the S&P 500 dropped 20% or more. Only 5 of those 13 instances went further than a 30% decline. Each one of those 5 were caused by either a commodity spike, aggressive central bank activity, or extreme valuations, none of which apply today.

2. Portfolio construction is working

Portfolio construction and diversification have mitigated these losses. If you review your 6-month or 1-year return, your loss is almost certainly lower than that of the indexes above. Here are the various ways in which we construct portfolios for downside protection. All of the below points are risk tolerance-permitting, so your individual portfolio makeup will depend on your risk tolerance, to ensure your portfolio is well-suited to your specific needs:

- Asset allocation: Most portfolios don’t consist entirely of equities, we also include fixed income within the overall portfolio makeup.

- Geographic and sector allocation: We haven’t gone all-in on one country or industry. Our aim is to build well-diversified portfolios with exposure to Canadian, U.S. and International markets.

- Tactical allocation: The investment managers in your portfolio are taking advantage of this volatility by buying equities at lower prices.

- Diversification: With up to 500 or more different holdings within a portfolio, the impact on the portfolio of one individual holding is generally minimized.

- Large-Cap focus: When building a portfolio, we prefer to focus on large-cap/blue-chip/dividend-paying companies for the equities position. These companies have historically been less volatile than the general market.

3. Major market declines are usually met with big rebounds

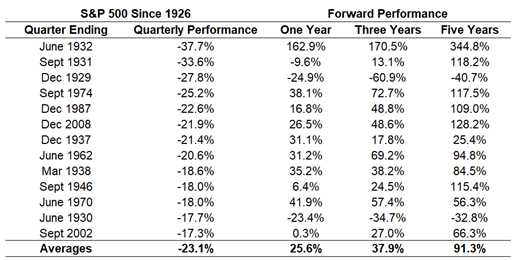

Here are the worst performing quarters in history for the S&P 500, along with one-, three- and five-year performance figures from the end of these terrible quarters:

You can see the ensuing 12-month, 36-month, and 60-month performance was positive the majority of the time, with respectable annualized gains.

Conclusion

We do not know for certain what lies ahead, but we do know that human behaviour can make it hard to process the types of losses we’ve experienced over the past few months. This can lead to impulsive reactions or poor decision making.

What we also know is that historically speaking, long-term investors have been rewarded by staying the course, or buying during pullbacks, rather than by running for the sidelines.

For long-term investors, volatility like that of the last few months isn’t something that should cause panic. Instead, it’s the price you pay for returns that, over long time periods, are likely to be significantly higher than those for cash or fixed-income.

Please contact us anytime if you want to discuss your investments in more detail.

We wish everyone a prosperous 2019!

Sources: Dynamic Funds

This information is provided for general information purposes only. It does not constitute professional advice. Please contact a professional about your specific needs before taking any action.