How have markets performed in 2022?

We are five months into 2022 and it is turning out to be one of the most challenging starts to the year in decades. This is said not because of the depth of the declines seen in asset prices, but rather due to the inability to diversify away some of the portfolio risk using the traditional asset classes. If the year closed out today, it would be the first time since at least 1970 when both global stocks and bonds were underwater.

The 2022 decline has rewound portfolio values back to where they were in the spring of 2021. Here are the year-to-date results, as of April 29:

- Canadian market (TSX): -2.2%

- US market (S&P 500): -7.7%

- US tech market (Nasdaq): -19.8%

- International markets (MSCI EAFE): -11.5%

- Bond market (FTSE TMX Canadian Bond): -10.2%

Note that the decline has been systematic and widespread. This is not a “portfolio issue”. Domestic equities, global equities, and fixed-income markets are all down for the year.

What is causing this decline?

The accommodative lending conditions (stimulus) put in place by central banks at the start of the pandemic are being unwound.

In March 2020, in reaction and anticipation of negative financial impact caused by COVID-19, central banks around the world lowered interest rates and implemented quantitative easing programs, which had the effect of increasing consumer and business spending and propelled markets to all-time highs in 2020 and 2021.

At the same time, the pandemic caused supply-side constraints. Labour and part shortages were well documented in the past two years. More recently, the Russia-Ukraine war is causing supply-chain issues in commodities.

The combination of increasing consumer/business demand against fixed or declining supply leads to an increase in prices, or inflation. This can be observed in the cost of gas, food, furniture, cars, and home.

In the second half of 2021, reports of 4-8% inflation started coming out, far exceeding the central bank target of 2%. With actual inflation far exceeding the central bank target, central banks have no choice but to “take their foot off the accelerator” and increase interest rates, causing a repricing event in markets.

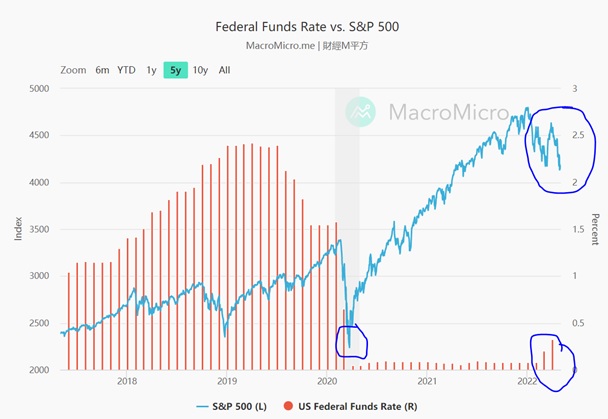

Can you provide a chart to better explain this?

The 2020-2022 rate cycle and its impact on the markets is visualized below. The red line indicates the U.S. Federal Reserve overnight lending rate, and the blue line is the S&P 500, a major US market index. You’ll see the rate declines in March 2020 met with the S&P 500’s bottoming out. You’ll see the S&P 500 increase throughout 2020 and 2021 while rates remained low. Finally, you’ll see the volatility set in 2022 as rates start increasing.

How long do you expect this to last?

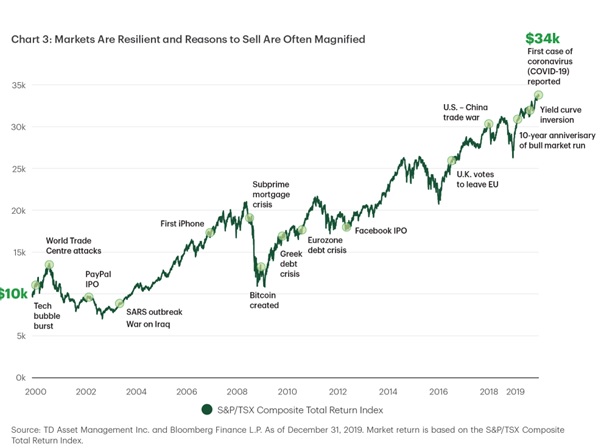

It is impossible trying to predict the magnitude or length of a pullback. However, pullbacks of this nature are a normal part of the market cycle and happen frequently:

Why are markets up this week? (Answer courtesy of Myles Zyblock, Chief Investment Strategist, Dynamic Funds)

The U.S. Federal Reserve announced Wednesday that it was raising the funds rate by 50 basis points to 0.875%, the largest increase in the policy rate at a given meeting since 2000. They also announced that they were going to shrink the size of their $8.9 trillion balance sheet by $47.5 billion per month starting on June 1 and, after three months, the run-off would then increase to $90 billion per month. This latter decision is more commonly referred to as quantitative tightening

The big news happened shortly after 2:30 p.m. EST, when Chairman Powell responded in the follow-up press conference to a reporter asking whether something even larger than a half-point increase in the funds rate could happen within the next few meetings. He said that a +75 basis point increase was not something the Committee was actively considering. The Federal Open Market Committee believes that something like +50 basis points in each of the next two meetings seems appropriate given current readings on inflation, the labor market, and overall financial conditions.

Heading into the meeting, the equity market was concerned that we might see an even more aggressive tightening path than what was recently being signaled by the policy authorities. News that a 75 basis point rate hike is off the table immediately launched the S&P 500 3% higher. Treasury yields also fell across the curve, particularly for the shorter-dated maturities.

So where does that leave us? The Fed is deeply concerned about the elevated level of inflation and will continue to raise interest rates in order to help moderate these pressures. The funds rate has risen by 75 basis points since March 2022, and the Chairman said that he views current interest rate expectations as appropriate. Given what fixed income futures are currently pricing, this suggests that the Fed is set to lift the policy rate by somewhere close to another 200 basis points in the five meetings remaining before the year closes out.

I’m 10+ years out from retirement. Do I need to do anything?

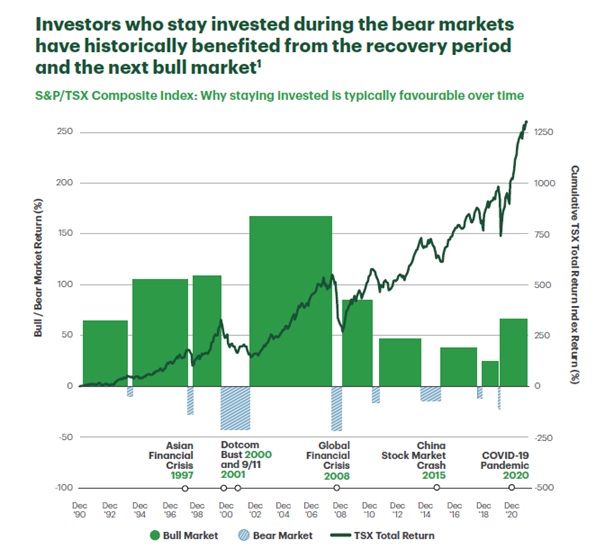

Probably not. Historically, equity markets have risen more than they’ve fallen, and the data speaks for itself — studies have shown that moving in and out of the market (i.e. market timing) may often mean limited gains and increased losses for investors. Investors tend to sell at the onset of sudden volatility, causing many to miss out on any subsequent market rebounds.

Your objective as an equity investor is to achieve growth-like returns exceeding that of cash or savings. This pursuit of long-term gains comes at the occasional cost of short-term declines.

Your portfolio was constructed based on your risk tolerance and investment objectives. Downside risk is addressed in your portfolio by annual rebalancing and by allocating your money into different asset classes, sectors, and geographies.

If are you contributing monthly to your portfolio, the decline has the benefit of averaging down the cost of your purchase. If you have cash on the sidelines you’ve been meaning to add to your long-term savings, this decline has created a potential buying opportunity.

Please contact us if you wish to discuss your portfolio in more detail.

I’m about to retire or am retired. Do I need to do anything?

Probably not. Your portfolio construction should reflect your pre-retiree or retirement status. We have likely identified your short-term cash flow needs and set this aside in a safer “cash-wedge” portion to your portfolio. We are likely exposing you to safer equities through low-volatility or dividend funds.

Please contact us if you wish to discuss your portfolio in more detail.

Do you have any other resources on monetary policy?

If you wish to learn more about the connection between central banks and financial markets, we encourage you to read our article on monetary policy written last fall.

Conclusion

Despite our emotions regarding the market, when we look through a historical lens, we can see that markets rebounded from negative factors impacting their performance, and eventually surpassed their previous highs.

If you wish to discuss your investment mix or portfolio strategy in more detail, please do not hesitate to contact us.