Many of our investment partners release economic and market commentary, and the purpose of this article is to summarize the key opportunities and risks these companies are seeing as we near the final quarter of 2020.

The first quarter of 2020 was a period of unprecedented volatility as COVID-19 took hold and lockdowns caused global economic havoc. Risk assets rallied aggressively from their March lows as many countries learned to better manage virus spread and economies gradually started to re-open.

Naturally, COVID-related uncertainty and the lasting effects of the pandemic on the economy are common issues highlighted from the economists and strategists below. Their viewpoints differ, but overall, a common thread is the notion that the rapid recovery we have seen since late March is not sustainable, but investors should be cautiously optimistic for the remainder of 2020.

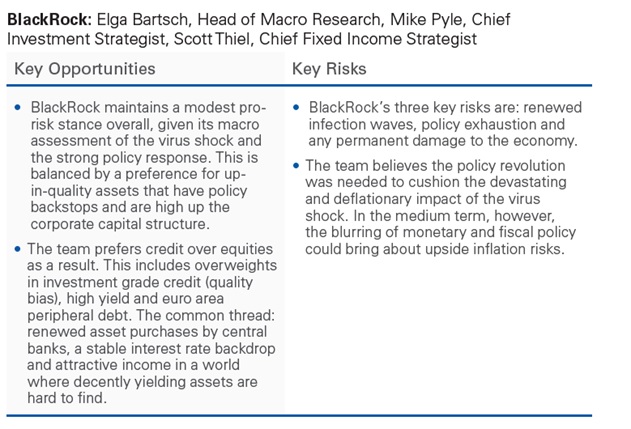

BlackRock Outlook: BlackRock advocated for taking advantage of risk assets in strategic portfolios in late-March. The firm has since turned neutral on equities in its strategic framework after the significant rally but keep an overweight in credit. Higher spread levels make up for increased default risk. The team has downgraded U.S. equities to neutral amid risks of fading fiscal stimulus and election uncertainty, and have turned cautious on emerging markets. The team has upgraded European equities as it offers the most attractive exposure to a cyclical upswing. The team is keeping credit overweight because of a global hunt for yield and central bank purchases.

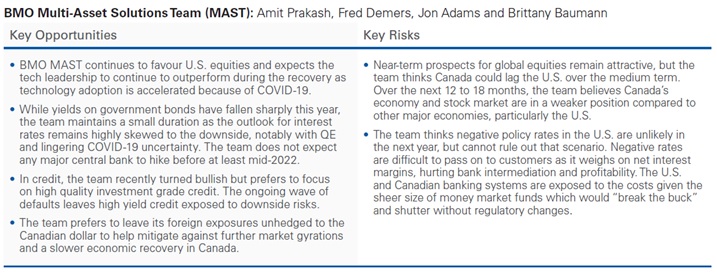

BMO Outlook: BMO MAST expects the whatever-it-takes monetary and fiscal policy actions to remain significant tailwinds for risk assets in 2020, although it does expect market volatility to remain above normal. The team downplays the fear of a second wave and does not expect another round of massive economic shutdowns. The team thinks the loonie has little upside potential as it sees Canadian growth lagging the U.S. in the next 12-18 months. The synchronized policy response of governments and central banks is unprecedented by its speed and size. 0% interest rates could push stock valuations to cyclical highs as investors are forced into riskier assets to generate yield.

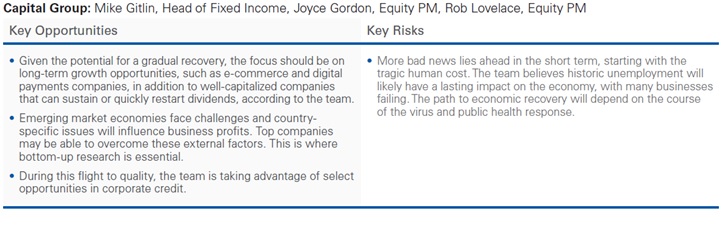

Capital Group Outlook: Because this economic decline is policy driven, the team believes a solid recovery is likely as lockdowns end. Easy monetary policy, aggressive fiscal policy and zero-bound interest rates should continue to support equity markets. The recent investor stampede into cash is understandable, but investors should consider the risks of holding excessive cash and trying to find the right time to re-enter the market.

CIBC Outlook: In de la Durantaye’s baseline projection, a vaccine is expected to come in the spring of 2021. If this forecast materializes, the global economy may very well recover faster than generally expected because of the colossal efforts deployed by governments and central banks around the world, with global growth accelerating to +3.4%. This assumes that the global pandemic doesn’t take a turn for the worse. He believes the U.S. economy will recover more rapidly than generally expected. U.S. real GDP growth is projected to average +1.0% over the forecast horizon. With inflation projected to run well below target, the Fed will keep its ultra-accommodative policy stance in place over the whole forecast horizon.

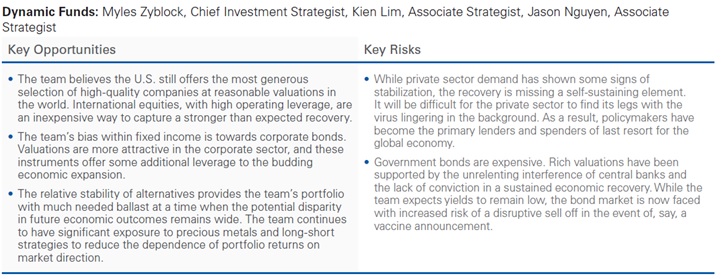

Dynamic Funds Outlook: The team feels the rapid pace of recovery that has taken hold over the past few months is unlikely to be sustained. The spread, particularly in the U.S., will begin to place some downward pressure on mobility patterns and economic activity. It is too early to suggest the risk of a renewed downturn, but the team’s focus has switched to looking for pockets of economic vulnerability. Income support, depressed capital costs, and better economic momentum are working together to help raise the floor under global equity prices. Investors willing to take significant off-benchmark equity positions can reduce the valuation risk in their portfolio.

Fidelity Outlook: Timmer feels the direction the stock market may take from here is not as clear as it was at the end of March. There are some things working in favour of stocks going up—and also against them. On the plus side, earnings look better than expected so far and monetary policy has provided liquidity and support for the recovery. Indicators of internal strength in the market and investor sentiment are also holding up. And, last but not least, there is some optimism around treatments and vaccines for COVID-19. Some of the negatives include the increasing spread of the virus in parts of the U.S. and the potential damper that could put on the recovery as businesses continue to struggle; finally, there may be uncertainty with an election coming up. Overall, Timmer thinks the positives continue to outweigh the negatives.

IA Outlook: As the global economy is showing signs of re-acceleration and the main geopolitical tail risks look poised to take a turn for the better, a structural but careful risk-on strategy should perform well in 2020, according to Gignac. He advocates not overreaching for returns, carefully monitoring and managing risks and, finally, being prepared to be active, as markets should give more opportunities to add value to portfolios.

Manulife Outlook: Petursson sees an economic recovery that is enjoyed globally but perhaps at a different pace market-to-market. In general, equity market gains are unlikely to reflect the full earnings growth as P/E multiples adjust lower (as they typically do in a strong earnings recovery). He believes the trailing S&P 500 Index 12-month P/E ratio falls one or two points through to the end of 2021 to 20x-21x earnings. Despite higher inflationary pressure into 2021, he feels central banks will remain accommodative through the entire period, not looking to raise rates until well into 2022. Yield curves steepen as the recovery combined with the inflationary forces of fiscal and monetary stimulus push longer-term yields higher. Overall, Petursson believes it is a good opportunity to continue to gradually increase the equity weight in his model portfolio by 5% to 60%, bringing his asset allocation back to neutral.

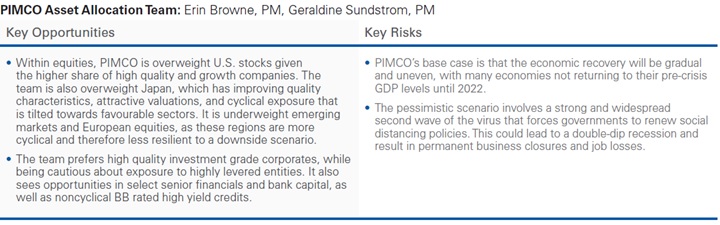

PIMCO Outlook: The team believes that risk assets valuations (equity and credit) are approximately fair, after adjusting for easy financial conditions and assuming a gradual economic recovery. Nonetheless, the distribution of potential economic scenarios over the next 12 months is unusually wide. As such, the team believes investors should maintain a moderate risk-on posture in multi-asset portfolios with a focus on companies with strong secular or thematic growth drivers that are positioned to deliver robust earnings in a tepid macro environment. As always, robust portfolio diversification is critical, but achieving this requires a multi-faceted approach. Duration, real assets, and currencies all can play an important role. The team believes the next few quarters will present a great backdrop for active management as the nature and the pace of the recovery will create many winners and losers. That should provide a plethora of opportunities to add value through sector selection and tactical asset allocation.

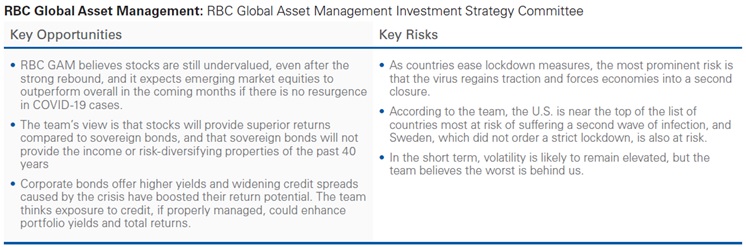

RBC Outlook: RBC GAM’s scenario analysis suggests further upside for stocks is possible as long as investor confidence stays elevated, inflation and interest rates remain low, and earnings rebound toward their long-term trend. The base case outlook for the U.S. is for a 7.1% decline in 2020 GDP. There is evidence that the US dollar bull market has come to an end and the team believes the Euro and Yen are to benefit, while the Loonie and British Pound will lag. If faster inflation does eventually materialize, the long-established style trend of quality and growth outperforming value may finally reverse. The team has adjusted the strategic neutral weights in its multi-asset and balanced portfolios in favour of stocks at the expense of bonds. For a balanced, global investor, the team currently recommends an asset mix of 61 percent equities and 38 percent fixed income, with the balance in cash.

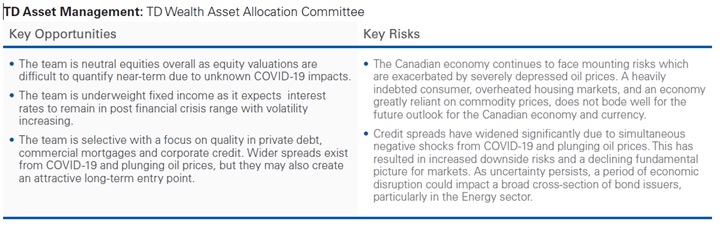

TD Outlook: The team has an overall neutral outlook for equities and continues to prefer equities over fixed income. It maintains a modest bias toward U.S. stocks versus Canadian. While there is no definitive way to estimate the degree of damage COVID-19 will cause to corporate and global growth, the team believes in the resiliency of the U.S. economy which should get a much needed boost from accommodative monetary policy and fiscal stimulus measures. Significant downgrades to economic forecasts have increased the probability of a short and sharp recession. The team remains defensively positioned with a neutral view to emerging markets debt while seeking attractive opportunities should they arise.

Source: IA Wealth