As we approach the end of 2022, here is a “state of the market” which shows where we are and provides a potential glimpse into the next year.

Firstly, some high-level commentary from Myles Zyblock, Chief Investment Strategist at Dynamic Funds:

The next year’s outlook represents a fine balance between further monetary policy tightening and an economic slowdown. Inflation is hovering at an uncomfortably elevated level for most of the world’s major central banks, suggestive that higher interest rates are in tow. Yet, declining growth rates point to the dangers of further monetary restrictions.

An approaching pause in the monetary tightening cycle at some point in 2023 seems obvious. High-quality bonds should benefit. The performance of riskier assets will depend on the depth of the economic slowdown. An economic recession accompanied by declining corporate earnings growth might open the door to further price declines in the equity and high-yield corporate bond markets.

Meanwhile, a soft economic landing would set the stage for an “everything” rally.

We are of the opinion that downside economic risks will remain a dominant feature into the first half of 2023. Non-cyclical equity sectors, such as Health Care, and high-quality bonds are the preferred habitat in this environment. “Risk-on”, or pro-cyclical portfolio positioning, probably requires an upturn in leading economic data.

(End of Myles Zyblock commentary)

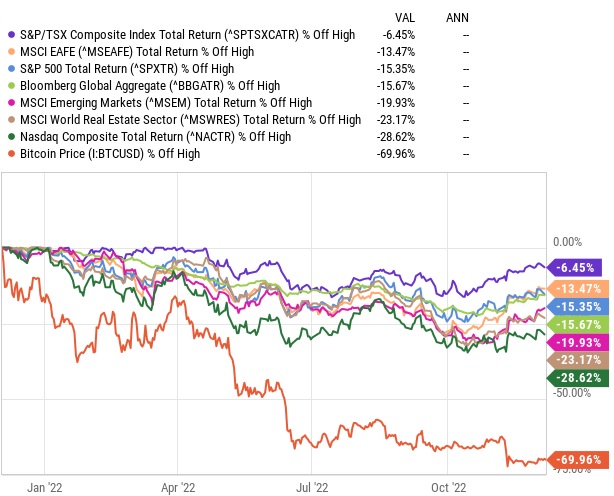

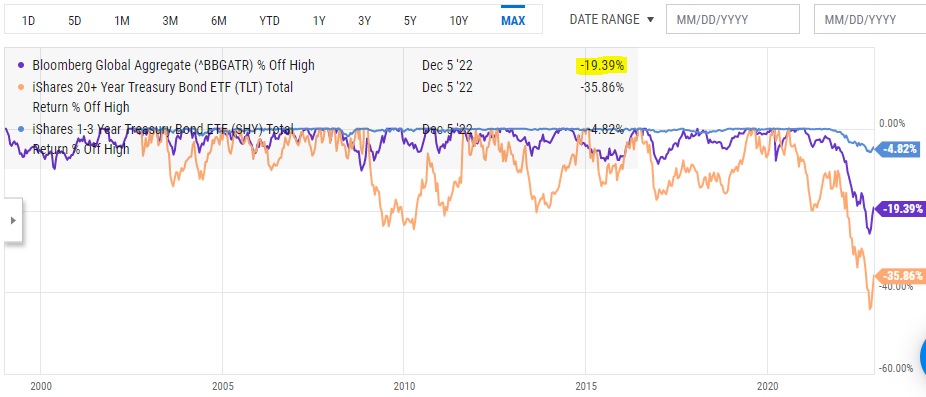

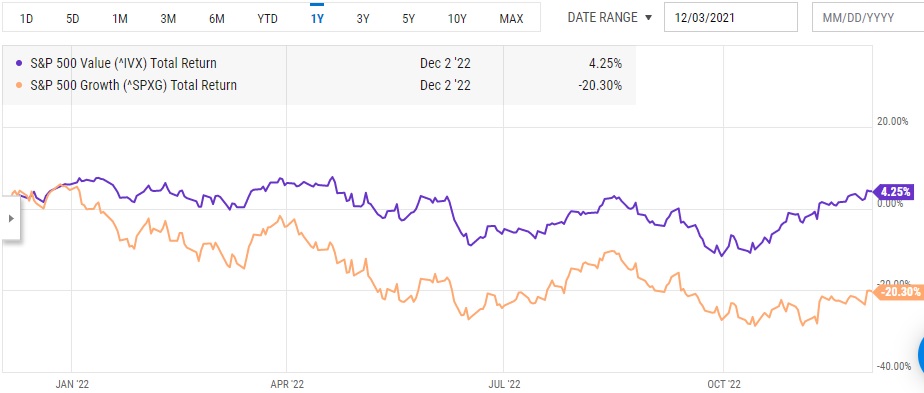

Next, we have culled a few informative charts courtesy of Fidelity Investments, which provide some context to the year that was in 2022.

Over the past year, most asset classes have faced negative total returns. This chart shows the decline from the high of the past year in percentage terms:

Bonds have had one of the most challenging years in history:

Value dramatically outperformed Growth as a style:

Inflation remains stubbornly high:

But yield is finally back to an attractive level for fixed income assets:

As always, we welcome your questions and comments.

Sources: Dynamic Funds, Fidelity Investments

Holiday Office Hours:

Please be aware that our office will be closed on Monday December 26th & Tuesday December 27th in observance of Christmas Day and Boxing Day, and on Monday January 2nd 2023 in observance of New Year’s Day.

On behalf of all of us at You First, we wish you and yours the happiest of holiday seasons and the very best for a prosperous 2023!