The deadline to make an RRSP contribution for the 2017 tax year is March 1, 2018. Most of you are familiar with the basic mechanics of the RRSP and its use as a long-term retirement vehicle. You are also likely aware of the RRSP Homebuyer’s Plan (HBP) which allows you to withdraw up to $25,000 from your RRSP for the purposes of buying your first home.

The RRSP also offers other, more immediate advantages. If you are a parent, student or recently laid off employee, here are three ways you can benefit from an RRSP contribution:

Parents: An RRSP contribution will increase your Canada Child Benefit (CCB). Every parent with children under the age of 18 receives CCB payments from the federal government. For each child aged 0-5, there is a maximum benefit of $6,400. For each child aged 6-17, there is a maximum benefit of $5,400.

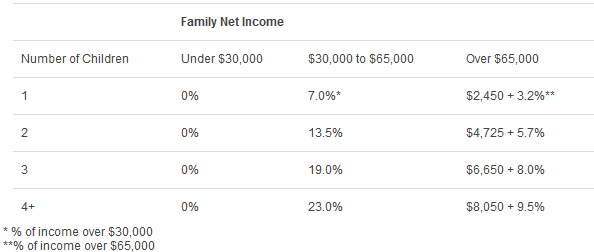

The benefit amount is calculated based on the family income for the previous tax year and it is subject to clawback starting at the $30,000 mark. Here’s the clawback table (click to enlarge):

For example, a family with 2 children and total household income of $120,000 is subject to a 5.7 per cent CCB clawback on each additional dollar of income. Therefore, when someone in that household makes an RRSP contribution, they are not only saving taxes at their marginal tax bracket (28-40 per cent), they are also increasing their CCB payment for the next year by 5.7 per cent!

Students: Similar to the Homebuyer’s Plan, with the Life Lifelong Learning Plan (LLP) you can withdraw up to $10,000 in a calendar year twice in a five-year period for the purposes of attending a qualifying educational institution.

Employees: Have you recently been laid off or lost your job and been given a severance package? This severance will be considered standard income, and therefore, it will be taxable in full. However, room-permitting, you can contribute some or all of your severance into your RRSP to avoid paying taxes on it.

In addition, for every year prior to 1995 that you worked with the employer you’ve just been laid off from, you get an additional $2,000 in RRSP limit to help mitigate the tax implication of your (potentially large) severance payout.

Bonus Coverage: A Cautionary Tale

Do you have a pension through your work? Does your workplace pension function as your primary retirement income vehicle? That’s great… as long as the company remains afloat. But if the company files for bankruptcy, some or all of your pension may be at risk.

Imagine having what you feel to be a solid retirement plan, with multiple income streams lined up: Canada Pension Plan, Old Age Security (for now), and your workplace pension, perhaps some rental income or some small investment income. Now, imagine up to half that income disappearing virtually overnight. It’s not impossible.

For a very recent example, take the downfall of Sears Canada. Long-time workers and retired pensioners alike were delivered the news that Sears Canada entered bankruptcy protection on June 22nd, 2017. Now these long-serving, loyal employees and retirees will see their pensions slashed by about 19% at a minimum. That figure could also increase in the future.

What is the lesson here? From the perspective of the saver, the lesson is simple: do not rely on any one income stream at retirement, no matter how seemingly foolproof. As much as you are able to, diversify your savings and save for your retirement using a tax-sheltered vehicle such as the RRSP.

You will get a tax savings on your subsequent return, your RRSP will grow in a tax-sheltered environment, and most importantly, you have control of your RRSP. So take action, as even a small amount now makes a big difference later.

If you have any questions about these tips, please don’t hesitate to reach out to us.

Next week, we will send out an RRSP deadline reminder to all eligible clients.

Sources: Dynamic Funds, Canada.ca