I want to preface this section by saying that we are still operating with a high level of uncertainty and there are a wide range of possible outcomes associated with COVID-19 and our economy.

Even if the current lockdown conditions are lifted soon, there will still be a need for social distancing, the wearing of proper masks, and a staged re-opening process that remains predicated on controlling the spread of the virus. This framework is encouraging, but it also implies a gradual, not speedy, return to normalcy as the most likely scenario.

It is also important to be aware of the many longer-term implications for society and capital markets that have arisen from this crisis. Issues like universal basic income, the role of government in supporting the economy (socialism vs. capitalism), the printing of money to finance fiscal spending, the potential de-globalization of the supply chain, and the evolution of corporate balance sheets. No one can be expected to have a perfect read on the interplay between these issues in the years to come. For this reason, all predictions, mine included, should not be leaned on too heavily.

Investment philosophy also determines buying decisions. If a company’s share price declines 80% from $50 to $10 and then rallies 50% to $15, it ultimately remains down 70%. This may be great for day-traders but it is not an example of a company that will thrive in the post COVID-19 world. We generally want to focus on companies who can grow their earnings in the long-term.

With all the disclaimers out of the way, I will try to summarize some of the consensus ideas I am observing in the investment world.

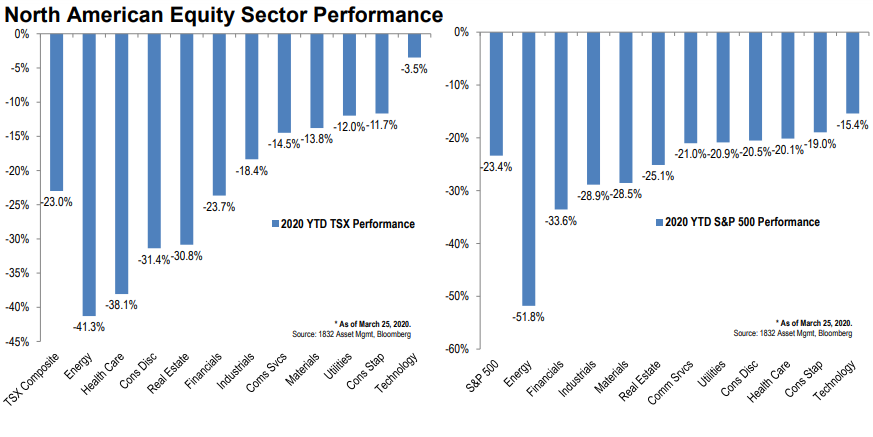

A few weeks ago, I posted the following sector performance chart for the Canadian and U.S. markets, which roughly reads as a ranking of most to least economically sensitive industries (from left to right).

It also reads as a list of investor sentiment around these industries (least to most confident, from left to right) for the foreseeable future.

Let us start with the most beat-up sectors like energy, financials, industrials, and consumer discretionary.

Energy companies include oil miners, refiners, and pipelines. The barrel of oil was at $100/barrel as recently as 2015, has hovered at $50/barrel the past few years, and currently sits at less than $20/ barrel. The short to medium term outlook for oil is not very strong and many companies in this industry have seen their share price decline between 60-80%.

Financials include the major banks, virtual banks, secondary lenders, and insurance companies. This sector has also been under pressure as investors assess the high unemployment numbers and the risk of consumer and business mortgage default. An insurer’s profitability typically rises and falls in line with interest rate increases or decreases. Lower interest rates make the insurance company’s products less attractive, resulting in lower sales and, thus, lower income in the form of premiums that the insurance company has available to invest.

Industrials include major manufacturers of airlines, construction equipment, electrical devices, defense, railroads, delivery services, and waste management.

Consumer discretionary are companies that produce non-essential goods and services, including automobiles, apparel, travel and hotel, media, and major restaurant brands.

It is not surprising that these industries have been the hardest hit, as they rely on a strong business environment and a consumer with discretionary income. However, we should not completely dismiss these sectors, which contain some of the largest, most recognizable, and well-managed companies on the planet. Railroads have always been viewed as great businesses. They have a high barrier to entry and they serve an essential role in the transportation of goods that likely is not going to change anytime soon. The Canadian banking sector is very strong and should never be counted out either. Lastly, the consumer will eventually return and resume buying cars, clothes, electronics, etc.

Investment funds who are introducing or increasing positions in the “best-in-class” names in these sectors at heavily discounted prices will likely be rewarded in the medium to long-term.

On the other end of the spectrum, we have the top-performing (or least negative) sectors of utilities, consumer staples, technology, and healthcare. Again, this should not too surprising. Utilities and consumer staples have never been economically sensitive. Whether the economy is strong or not, we need to buy groceries and other basic household goods, and we need heat and electricity at home.

I want to focus on technology and healthcare, as these two industries will likely form the leadership to emerge out of this crisis.

The tech industry is clearly benefiting from the “stay-at-home” economy. Many companies in e-retail, video streaming, cloud computing, video conferencing, food delivery, and online gaming have seen their share price increase since the onset of COVID-19. None of these are temporary trends and these sub-sectors will likely perform well in the medium to long-term. Automation will likely play a big role in the long-term as well. Finally, you have the infrastructure required to build this economy: fiber networks, lithography, process controls, etc.

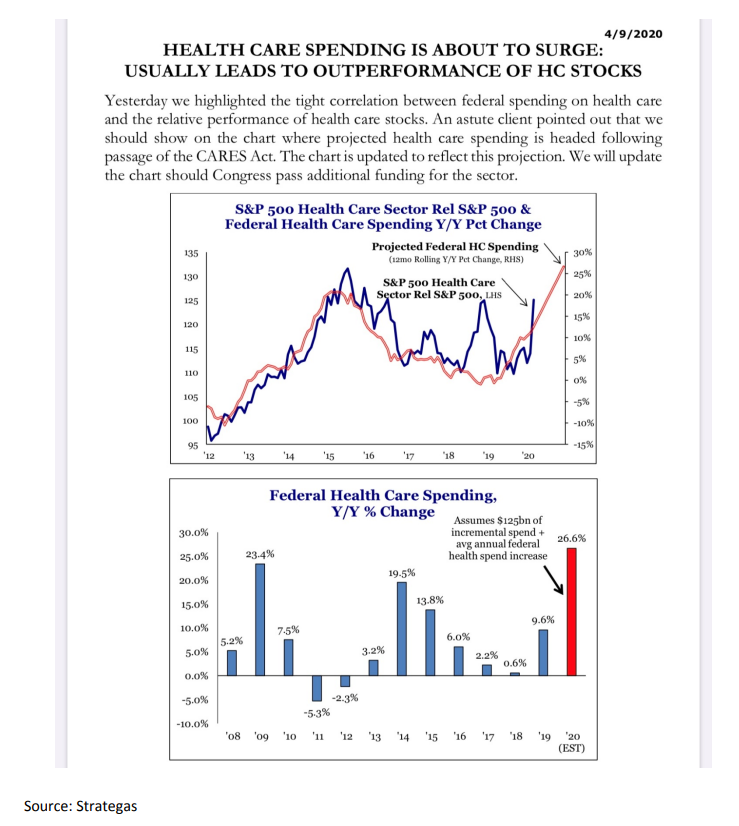

Healthcare was already seen as an industry that will benefit in the long-term from aging demographics and COVID-19 will likely help it even further. Private sector health care companies have increased production on behalf of the government. There is a very important public/private relationship in health care, and sector performance is strongly correlated to public sector funding:

Governments have oil and gold reserves and COVID-19 will likely influence them to have a “health care reserve” of basic raw materials like masks and ventilators to be better prepared for a health crisis. Many hospitals are pushing back elective or non-essential surgeries. When these resume, it will benefit medical equipment makers. Also, businesses that are involved in virtual doctors, vaccines, diagnostics, and procurement will likely benefit in the long-term.

Gold has traditionally done well during times of crisis. Coined (no pun intended) the “currency of fear”, it’s where investors go to when they lose confidence in paper currency.

The above projections are reflected in fund company positioning. Many portfolio managers have pivoted their funds to increase exposure in the sectors and sub-sectors mentioned above.

Every decade sees new company and new leadership emerge. Those companies that were still growing during the downturns of 2000 and 2008 were the biggest winners in the next cycle. There are many companies that are an essential part of our lives today that were not around or just in their infancy 10 years ago. Those investors who invest in quality names, diversify and remain patient will be rewarded in the long-term.