During times of market turmoil, it is common to feel the need to exit the market to “cut your losses”. However, time and again, history tells us that “cutting your losses” is more costly in the long run than you think. Here are a few charts explaining why we don’t sell during market declines.

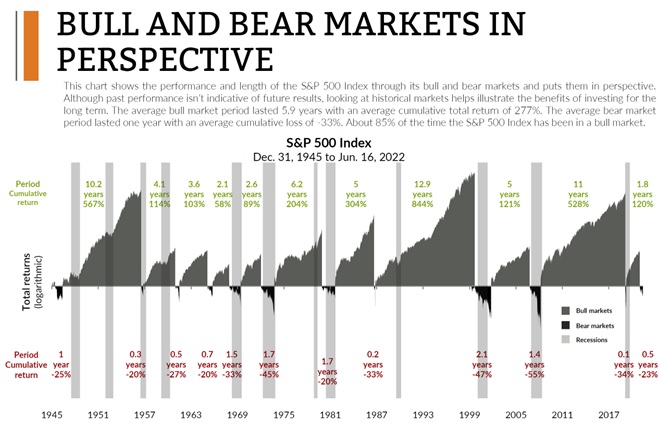

Markets are climbing 85% of the time: historically, markets are on an upward trajectory the vast majority of the time. Since the end of 1945, markets have been increasing ~85% of the time, with the average bull market lasting 5.9 years while the average bear market has lasted 1 year.

Negative headlines occur every year: there are negative news headlines every year, and some people react to this negative news by selling or staying on the sidelines. Yet the TSX has posted a positive return in 70% (21) of the past 30 years with an average return of 8.4% per year in that timeframe.

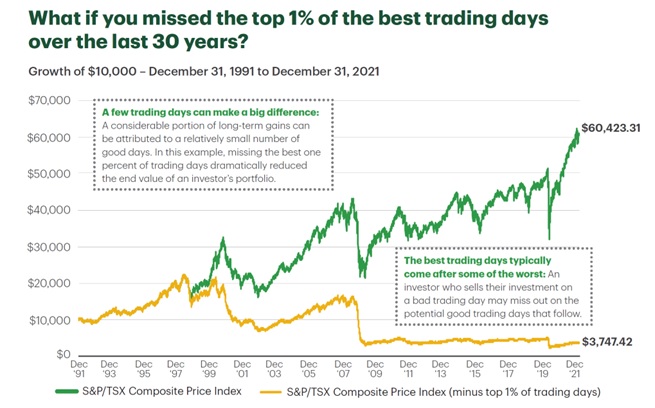

Missing out on top 1% of the best trading days can have drastic implications to your portfolio’s trajectory: without a crystal ball, it is virtually impossible to perfectly time a market bottom. Missing even a few days’ worth of a market rebound can be disastrous to your long-term portfolio value.

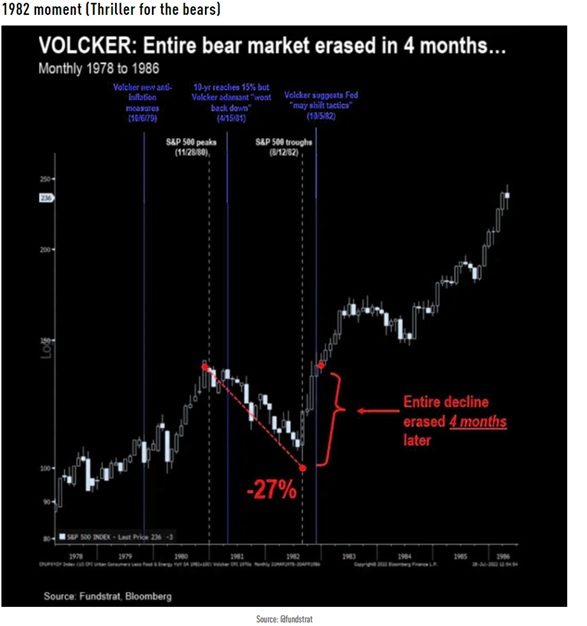

A 4-month market rally can erase 2 years of declines: adding to the above point, a market recovery can happen even in the midst of negative market sentiment. It is easy to miss the best part of a market recovery while waiting on the sidelines for “the right time”.

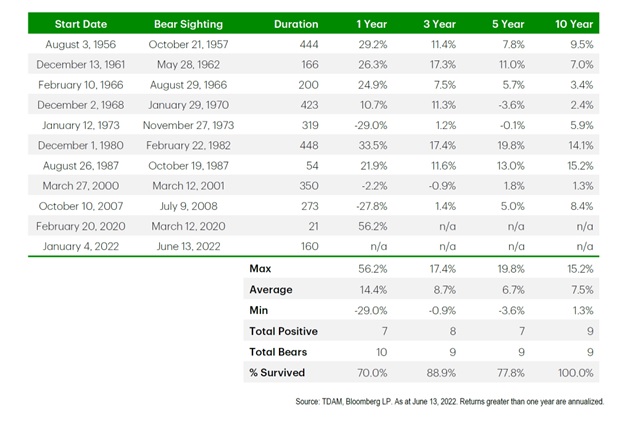

Investors who invested on the first day they saw a 20% decline (which has already happened for the US index this year) would have earned a positive return 70% of the time after 1 year, 89% of the time after 3 years, 78% of the time after 5 years and 100% of the time after 10 years: time in the market prevails once again. The confidence interval of a positive return outcome increases the longer you are invested.