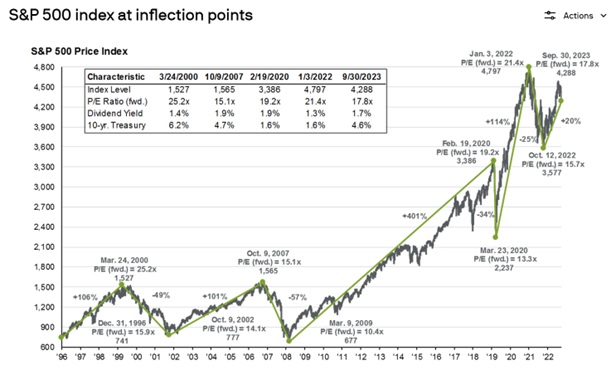

Over the past two years, investors have navigated through both the peaks and the troughs of financial markets. The notable double-digit decline in equities during 2022 was swiftly succeeded by a robust recovery in the concluding months of 2023. The final two months of 2023 saw a positive shift across asset classes, signaling broad market optimism.

As always, concerns and questions remain. Issues like inflation and the path of interest rates, recession risk, domestic elections, and mounting geopolitical tensions will ensure a choppy path forward for equity markets and the potential for leadership to change frequently.

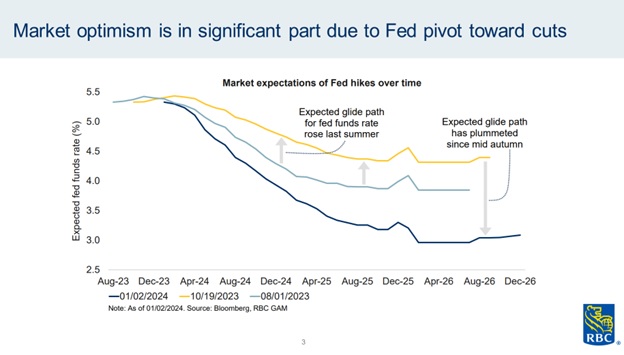

There’s a risk that growing expectations for substantial interest rate cuts in 2024 might lead to a premature economic response, resulting in rate cuts being pushed back. Central banks will continue to monitor consumption and employment trends to assess the right time to implement anticipated rate cuts.

For the year ahead, we expect positive – but slowing – economic growth, which should translate to modestly positive equity index returns. We therefore believe investors would be well-served with broad U.S. and Canadian equity exposures, enabling them to take deliberate risk where, and when, opportunities arise.

As is tradition, we start the newsletter by reviewing the major events of 2023 and looking ahead to 2024 through eleven key charts.

Market returns (as of December 29, 2023): Equities went on a mini bull run, with U.S. stocks in particular, ending December 2023 near all-time highs. Many sectors contributed to this run, including tech, consumer discretionary and communications.

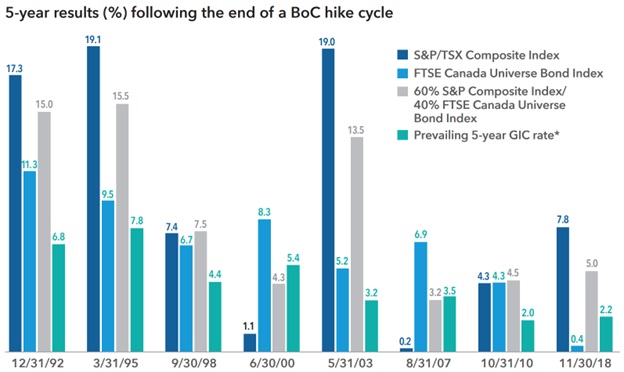

The rise in interest rates is also positive for bonds moving forward. Yields have reached highs not seen since 2008, which is great news for income investors. We now expect Canadian bonds to return an annualized 4-5% over the next decade, compared with the 1-2% annualized returns before the rate-hiking cycle began. The case for the balanced portfolio (60% equities, 40% fixed-income) is stronger than in recent memory.

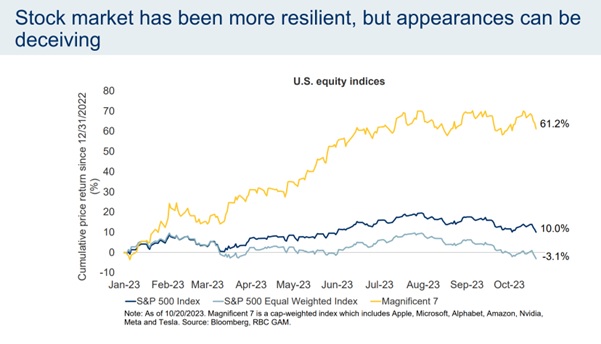

The Strength of the Magnificent 7: The impressive gains in 2023 were highly concentrated in just a few U.S. tech stocks, the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla). The Magnificent 7 make up about a third of the S&P 500, meaning the performance of U.S. equities will remain heavily dependant on the behaviour of these companies.

To put their dominance into perspective, at the end of October, these seven stocks accounted for over 100% of the YTD gains for the broader S&P 500 Index. In other words, the S&P 493 was negative on the year at that point!

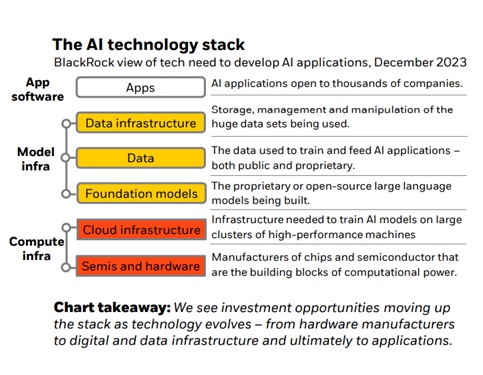

The launch of ChatGPT and other AI applications in 2023 fuelled returns for the 7 major tech stocks, which are all exposed to the AI theme in different ways.

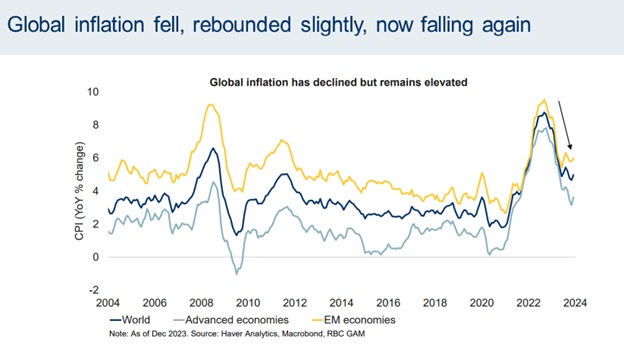

Central banks, inflation, mortgage rates, and market performance after a rate increase cycle: 2022 was defined by aggressive central bank rate increases to combat inflation, which peaked at 9% in 2022. Monetary policy has helped bring inflation back down and is partly why markets rallied last year.

The year-over-year inflation rate fell to 3.1% in October from 5.9% in January, which means we are slowly closing in on the Bank of Canada’s preferred level around 2%. The Bank of Canada held rates at 5%, pointing to a slowing economy. Governor Macklem said the Bank is still wary of inflation and will only consider interest rate cuts when its 2% inflation target is within reach.

Central bank rates set the bank prime rate, which sets the variable-rate mortgage lending rate, which jumped to the current ~7% from around 2.5% in 2020-21. Lower rates in 2024 would start the long process of undoing some of the damage caused by this rate surge.

The 5-year market performance following the end of Bank of Canada rate hiking cycles is historically strong.

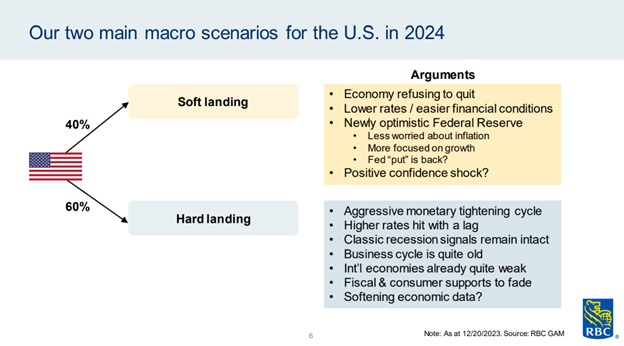

Recession risk remains: The short-term path of the economy remains unknown, with about a 50/50 chance of a soft or hard landing. If the U.S. Federal Reserve (Fed), Bank of Canada, and other central banks successfully thread the needle and we only see a mild recession, equities should react strongly.

In a soft-landing scenario, we can expect both equities and bonds to rebound to some degree, with equities likely having the larger rally. The big question is the duration of central banks’ interest rate pause – the sooner they stop raising rates, the longer the pause is likely to be, and vice versa. As a result, in a soft landing, you probably want to have a bias towards equities, and stay in fixed income rather than cash given that rates are likely to come down eventually.

A hard landing would be an ‘oops!’ situation for the Fed – a realization that they were too aggressive, too fast with rate increases and did too much damage to the economy as a result. In this case, they’d likely be forced to react by moving to cut rates much sooner, as a longer and deeper recession will quickly bring down inflation but cause too much pain to labour markets and to the consumer. In a hard landing, being positioned in fixed income will likely prove profitable, particularly given the higher yields we’ve seen in the last year versus the prior decade.

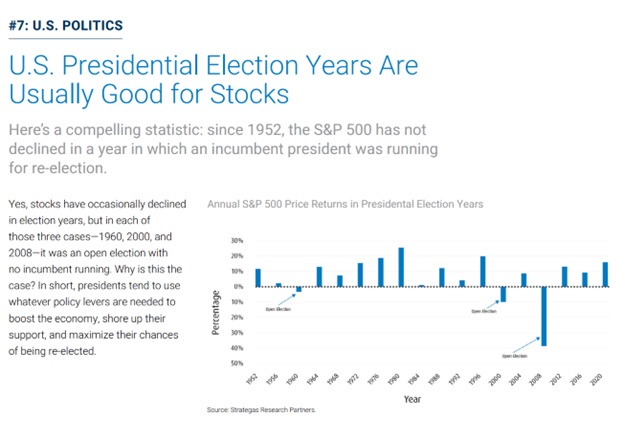

U.S. elections: Buckle up, it’s an election year. The impact of U.S. elections on stock markets can vary based on several factors, including the political and economic landscape, the policies of the winning candidates, and the expectations of market participants. In our view, it is the latter point that is the most powerful. Elections can introduce a level of uncertainty, and markets generally don’t like uncertainty. Investors may adopt a wait-and-see approach leading up to the election, and market volatility can increase. Once the election results are known, the clarity provided by the outcome can either boost confidence and lead to a market rally or create concerns that might result in a market decline.

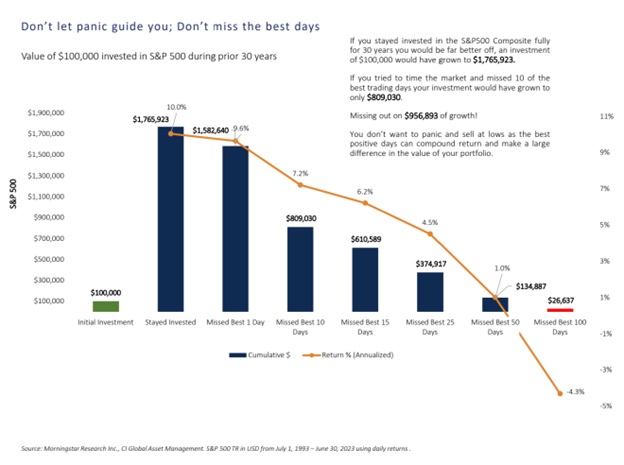

Resist the urge to time the markets: Market corrections have always been part of investing. Last year reminded us that after large drawdowns there are typically large positive days around the corner. You don’t want to panic and sell at lows as the best positive days can compound return and make a large difference in the value of your portfolio.

Regardless of where we are in the market cycle, it’s important to take a disciplined approach to investing, and to stay focused on your long-term goals. This strategy helps you keep your emotions out of investing, typically buying high and selling low like many investors do. Ongoing monitoring and reviewing of your portfolio also helps keep it on track. Diversifying investments reduces risk as well.

We are here to support you in achieving your financial goals. Please do not hesitate to contact us.