Stock markets have provided healthy returns in the first five months of 2024, reaching new all-time highs led by U.S. and Japanese stocks. U.S. firms have delivered strong earnings, reflecting a resilient economy. Although positive for investors, the pace of these rallies and the rising valuations are cause for caution, and could lead to near-term volatility.

Here’s a summary of the major markets and events in 2024.

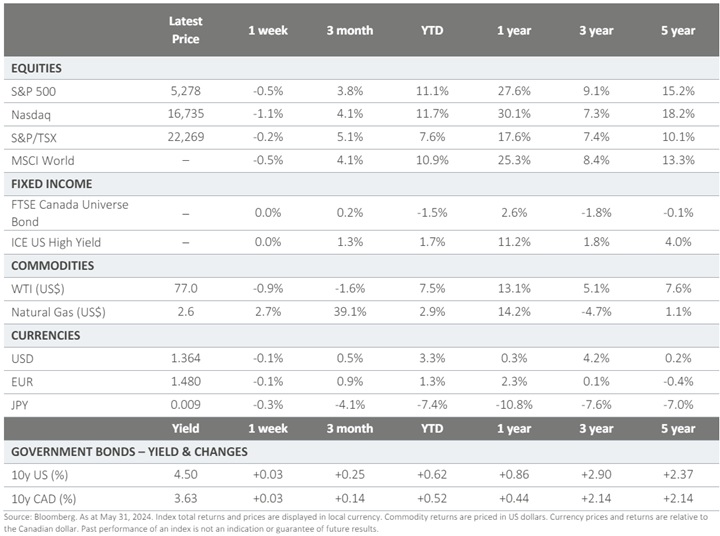

Key Indices Performance (as of May 31, 2024)

- S&P 500: The S&P 500 is up 11.1% for the year, buoyed by positive earnings reports, especially from companies involved in artificial intelligence (AI). This sector’s growth has been significant, contributing to the overall positive trend in U.S. equiti At the midpoint of Q1 earnings season, nearly 80% of S&P 500 companies surpassing analyst earnings estimates.

- NASDAQ Composite: The Nasdaq 100 index, which includes many of the largest non-financial companies listed on the Nasdaq stock market, has returned approximately 11.7% so far this year.

- TSX (Toronto Stock Exchange): The S&P/TSX Composite Index has gained approximately 7.6% since the beginning of the year. This growth has been driven by a strong performance in various sectors, including financials and energy, which have historically been significant contributors to the index’s movements.

- Fixed-Income: The Canadian fixed-income universe had a positive month as bond yields fell, with slowing inflation pointing to the start of rate cuts in Canada (with the first rate cut of 25 basis points occurring on June 5th). However, the asset class has remained in negative territory since the start of the year, underperforming Cash and Equities. Although the fixed-income category has struggled for several years in a rising rate environment, the expected lowering of interest rates provides a favourable outlook moving forward.

Key Themes and Trends

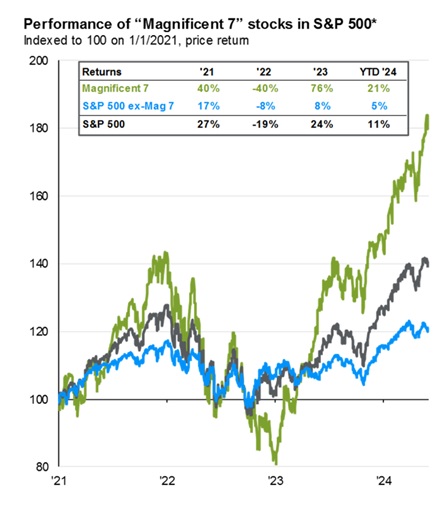

- Artificial Intelligence and Technology: AI and technology sectors continue to drive significant investment and growth. Companies involved in AI infrastructure, such as data centers, have seen substantial capital inflows, which is expected to continue as the demand for AI capabilities grows.

- U.S. elections: America will decide on its next President on November 5, and history shows that there will likely be heightened volatility between now and then, with average VIX (volatility index) readings typically elevated during election years compared to non-election years.

- Inflation and Interest Rates: Markets have responded favourably to lower inflation rates and central banks signaling lower interest rates in the months ahead. Headline Canadian CPI inflation edged lower in April to 2.7% year-on-year (y/y), matching expectations, moving the Bank of Canada’s (Boc) preferred inflation gauge into the 1-3% target range for the first time in nearly three years. The BoC and European Central Bank (ECB) lowered their respective overnight rates by 0.25% this week. The U.S. Federal Reserve (the Fed) has not lowered rates yet. However, rates will stay higher for longer, according to recent comments from the Fed.

Looking ahead, analysts expect continued growth, albeit at a slower pace. The focus will be on monitoring inflation, interest rates, and the geopolitical landscape, which will play crucial roles in shaping market performance for the rest of 2024.

U.S. equities are currently favourable due to strong growth, expanding positive earnings, and a robust domestic economic environment. This is particularly beneficial for sectors focused on the U.S. market, such as industrials. Themes like re-shoring, AI exposure, and electrification are prominent, with these sectors being closely tied to the U.S. economy.

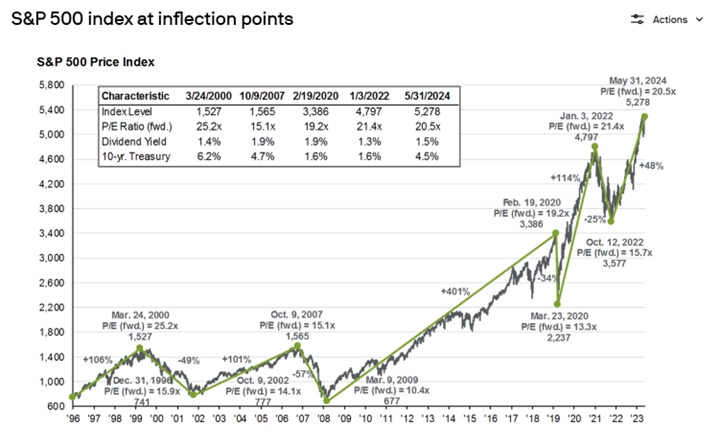

However, current valuations should also make us wary of a possible pullback, and overall portfolio diversification remains important. It is important to take a disciplined approach to investing and to stay focused on your long-term goals. This strategy helps you keep your emotions out of investing, typically buying high and selling low like many investors do. Ongoing monitoring and reviewing of your portfolio also ensures it remains on track.

Charts of Interest

Market Returns (as of May 31, 2024)

S&P 500 index at inflection points

This chart shows past market cycles in the S&P 500, highlighting peak and trough valuations, as well as index levels, dividend yields and the 10-year U.S. Treasury yield.

Performance of the “Magnificent 7”:

The “Magnificent 7” refers to the leading technology stocks within the S&P 500 Index. The chart on the left illustrates the performance of these seven stocks compared to the S&P 500, excluding the Magnificent 7. Although these tech giants have dominated market performance since 2023, they experienced significant underperformance in 2022, underscoring their higher volatility.

Sources: J