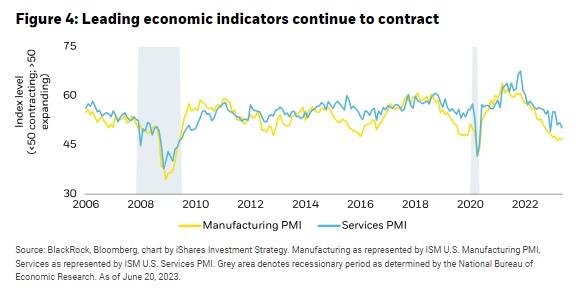

The first half of 2023 was defined by contrasting themes. On the recessionary data side, we saw a slowdown in the manufacturing sector, coupled with tighter credit conditions following March’s banking turmoil. On the soft-landing side, the labour market remains strong, with unemployment rates hovering near all-time lows. Inflation has moderated only slightly, despite the U.S. Federal Reserve (Fed) hiking interest rates 500bps to levels not seen since 2007. This points to a resilient consumer buoyed by stable earnings potential as wage growth remains firmly above the pre-pandemic decade.

Despite opposing signals in the economic data, 2023 market returns are positive, with the equity market pricing in an optimistic outcome on both growth and earnings. The second half of 2023 will be driven by inflation stickiness and central banks nearing the end of their hiking cycles, as well as corporate profitability challenges as companies deal with higher input costs.

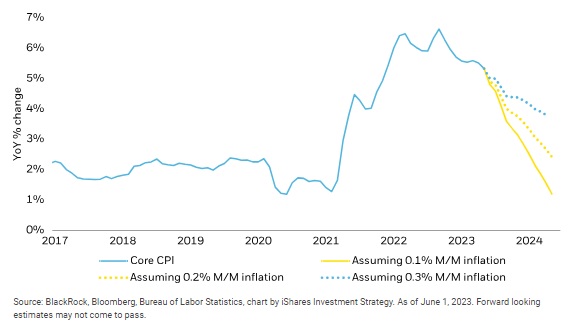

Potential inflation paths: The pace of inflation is declining but still needs to fall further. Central banks are counting on a growth slowdown to help lower inflation. The Fed has repeatedly talked about a “sustained period of below-trend growth” as a necessary precondition to bring inflation down to their 2% target. This time around, central banks may not respond to a slowdown with rate decreases; rather, they may need to keep rates at a restrictive level for an extended period.

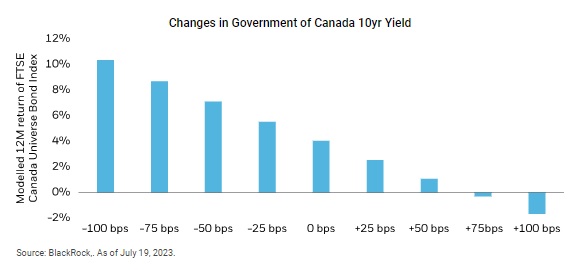

Switching from cash to high quality fixed income: Many investors are overweight cash, due to elevated fixed income implied volatility, and cash currently yielding about 4.5%. Rates appear set to peak with the approaching end of the central bank hiking cycle and investors may want to consider stepping into high-quality, medium-term fixed income (bonds with maturities between 3-7 years). On average, between 1990 and February 2023, core bond exposures performed 4% better than cash equivalents when the Fed held or dropped rates. The FTSE Canada Universe Bond Index now yields close to 4.4% and has a duration (or sensitivity to interest rates) of 7.3 years. Even if the Fed were to raise rates higher than current market expectations, the carry earned from higher coupons can be sufficient to counter losses realized by rising rates.

A (never-ending) case for defensive positioning: As discussed earlier, markets have come roaring back in 2023 despite conflicting economic data. Defensive portfolio positioning mitigates the need to speculate on soft landing vs. a recession. High-quality companies at reasonable prices, dividend-paying equities, and low-volatility equities are three solutions for investors to stay invested while being prepared for a variety of outcomes.

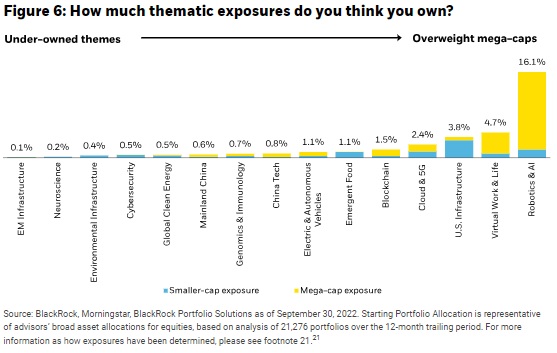

AI fuelling tech sector returns: Yes, you’re probably exposed to the AI theme. Since OpenAI’s ChatGPT release at the end of 2022, investors have sought exposure to the AI theme through a narrow list of mega-cap tech names, coined the “Magnificent 7” (Microsoft, Alphabet, Meta, Apple, Amazon, Tesla, Nvidia). This group of companies account for over a quarter of the S&P 500 and has returned just over 60% YTD.

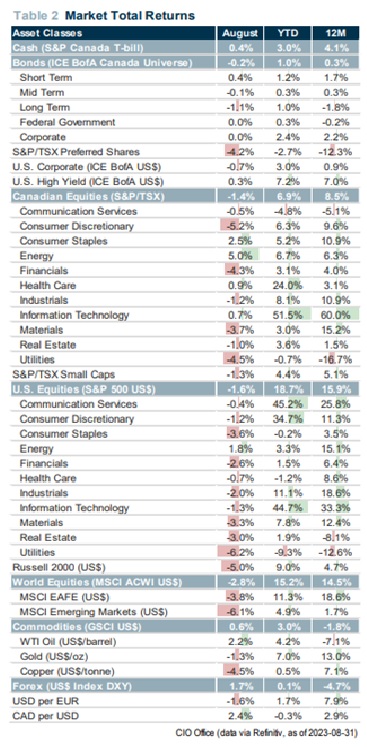

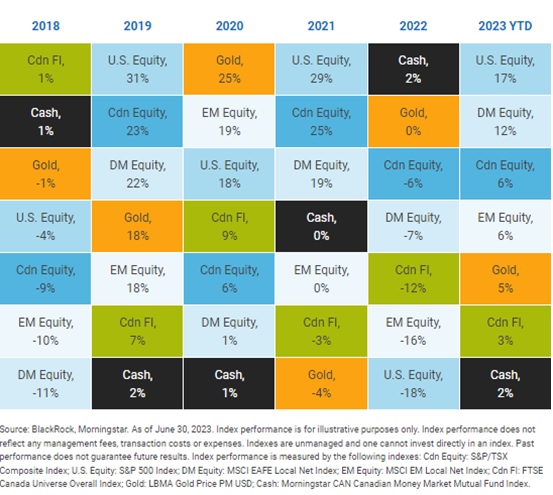

Total Return by Asset Class: U.S. equities were last year’s biggest underperformer and are this year’s largest outperformer, which is a common occurrence with markets. This is a repeat of the simple lesson about diversifying and avoiding market timing.

In summary, despite the growing popularity of a more optimistic outlook, we feel investors would be best served with a cautious asset allocation in the short term. A geographically diversified portfolio comprising various asset classes and exposed to different themes will generate returns across different market environments. This avoids the stress, the elevated volatility, and often the regret that go with more concentrated and aggressive portfolios.

We are here to support you in achieving your financial goals. Please do not hesitate to contact us.

Sources: RBC GAM, Blackrock, National Bank, CI Investments