There are two prevailing concerns that we’ve been asked about more recently: rate hikes and slowing growth. Courtesy of Myles Zyblock (Chief Investment Strategist, Dynamic Funds), we’d like to present some numbers relating to these issues.

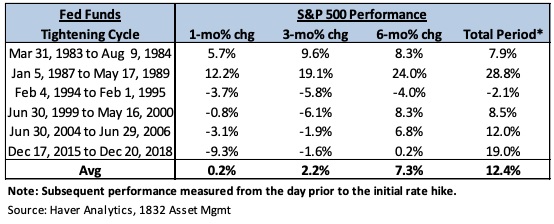

1) Rate hikes. Inflation has been a hot topic in the press with higher prices seen broadly from gas prices to lumber and used cars. As a result, pressure has increased on central banks to help cool the situation with rate hikes. In the U.S., the futures market has started to price in Fed rate hikes sometime next year and this is causing some concerns over what this might do to equities (see chart below).

Rate hikes shouldn’t be scary. Over the past six tightening cycles that we reviewed, only 1995 resulted in negative returns. However, many argue that the true end to that tightening cycle, under Chairman Greenspan, was May 2000, which would have resulted in a +200% return for the entire period. In the most recent example, for the 2015-2018 period, equities were up +19%.

We concede that this is a small sample size but if there’s a dip following the first rate hike next year, we would view it as a buying opportunity based on historical results. There might be greater concern if central banks were to start cutting rates, as that would imply that the economy was actually in trouble.

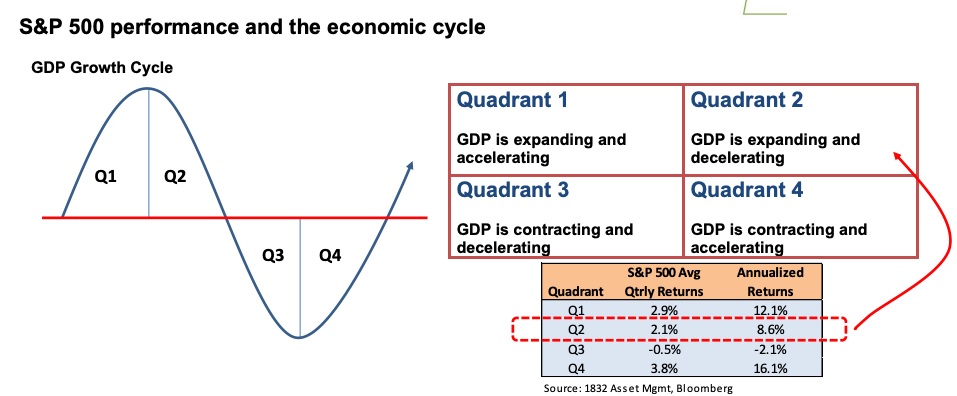

2) Slower economic growth: When leading indicators peaked earlier in the year, they signaled a pending downshift in economic momentum. With the recent data releases, including the U.S. GDP report, it is apparent that growth has indeed slowed. For Q3, U.S. GDP was reported to be +2.0% (quarter-over quarter, annualized) which is a marked slowdown from the prior quarter’s 6.7% pace. This data, along with others that have confirmed what the leading indicators had signaled in the spring, have raised concerns around what this might mean for equity performance.

In the graphics above, we’ve defined 4 quadrants to represent the different phases of the economic cycle. As well, we reveal our findings for the corresponding historical S&P 500 performance. The four quadrants are: (Q1) GDP expanding and accelerating, (Q2) GDP expanding and decelerating, (Q3) GDP contracting and decelerating, and (Q4) GDP contracting and accelerating.

S&P 500 returns are typically the strongest when the economy is contracting, but the growth profile is turning “less bad” (i.e., Quadrant 4 – contracting and accelerating). Interestingly, returns for Quadrants 1 and 2 aren’t too dissimilar. However, returns for a Q3 scenario (GDP contracting and decelerating) are clearly the ones to avoid as they are typically the worst. At this juncture we believe we are located somewhere within Quadrant 2.

Conclusion: While it might be concerning when we see economic growth decelerate, or when the Fed is about to tighten policy settings, it is important to keep in mind that if overall economic activity remains robust for both scenarios, equity prices will likely be supported. What we would fear is recession, but there are currently no indications that we are about to enter such a scenario

(end of Myles Zyblock commentary)

Weekly Update – By The Numbers

| North America | Friday Close | Weekly Change | Weekly % Change | YTD % Change |

| Canada – S&P TSX Composite | 20,739 | -152 | -0.73% | 18.96% |

| USA – S&P 500 | 4,621 | -91 | -1.93% | 23.03% |

| USA – Dow Jones Industrial Average | 35,365 | -606 | -1.68% | 15.55% |

| USA – Nasdaq | 15,170 | 15,170 | #DIV/0! | 17.71% |

| Gold Futures (USD) | $1,798.90 | $16.00 | 0.90% | -5.24% |

| Crude Oil Futures (USD) | $70.40 | -$1.27 | -1.77% | 45.09% |

| CAD/USD Exchange Rate | $0.7750 | -$0.0119 | -1.51% | -1.39% |

| Europe / Asia | Friday Close | Weekly Change | Weekly % Change | YTD % Change |

| MSCI World Index | 3,140 | -48 | -1.51% | 16.73% |

| Switzerland – Euro Stoxx 50 | 4,161 | -38 | -0.90% | 16.49% |

| England – FTSE 100 | 7,270 | -27 | -0.37% | 12.52% |

| France – CAC 40 | 6,927 | -65 | -0.93% | 24.79% |

| Germany – DAX Performance Index | 15,532 | -91 | -0.58% | 13.22% |

| Japan – Nikkei 225 | 28,546 | 108 | 0.38% | 4.02% |

| China – Shanghai Composite Index | 3,632 | -34 | -0.93% | 4.58% |

| CAD/EURO Exchange Rate | € 0.6895 | -€ 0.0072 | -1.03% | 7.18% |

| Fixed Income | Friday Close | Weekly Change | Weekly % Change | YTD % Change |

| 10-Year Bond Yield (in %) | 1.4020 | -0.0870 | -5.84% | 53.06% |

Sources: Dynamic Funds, Yahoo! Finance, CNBC.com