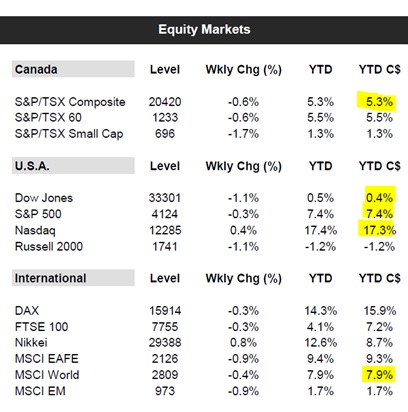

The promising start to 2023 continued for investors in April as stocks posted more gains, bond yields were stable, and inflation cooled again. However, concerns remain around the direction of central bank interest rates, the debt ceiling, and consumer spending. Here’s a summary of the main events that steered the markets.

Markets are up since Oct 2022: After reaching a maximum drawdown of -25% on October 12, the S&P 500 has begun an impressive recovery. The U.S. index is up 15% gain since its last trough supported by decelerating inflation and a resilient labour market.

Inflation is clearly descending: U.S. inflation figures showed a decline to 4.9% year-over-year, which may support the idea of rate hikes having the intended impact and increase the likelihood of a pause at the next U.S. Federal Reserve meeting. Although inflation appears to be cooling, it may take more than a year to return to desired levels.

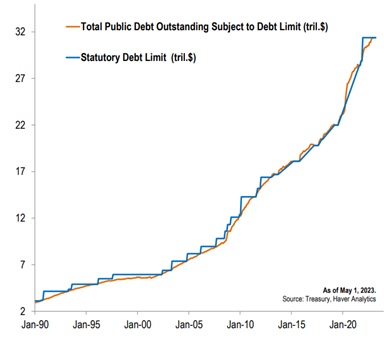

The politicization of the Debt Ceiling:What is the debt ceiling? Effectively, in the U.S., it is the amount of debt that Congress sets that limits the amount of money the federal government, through its Treasury, is allowed to borrow to pay its obligations. If the debt ceiling isn’t raised, the Treasury would ultimately run out of money, thereby defaulting on America’s obligations. U.S. President Joe Biden and top congressional Republican Kevin McCarthy reached a tentative deal on Saturday to raise the federal government’s $31.4 trillion debt ceiling, aiming to stop the U.S. from defaulting on its debt. The U.S. House Rules Committee said it will meet on Tuesday afternoon to discuss the debt ceiling bill, which needs to pass a divided Congress before June 5.

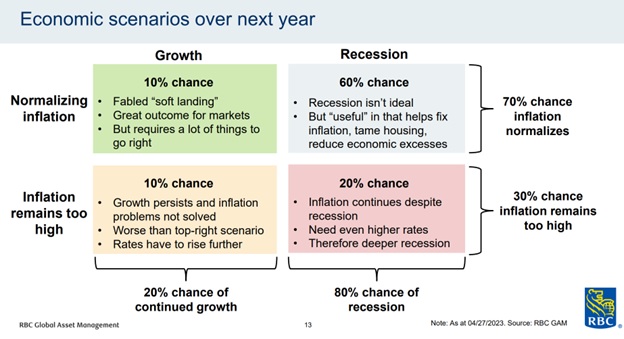

A recession is the most common economic scenario over the next year: What happens next in markets depends largely on whether or not the U.S. economy will fall into recession.

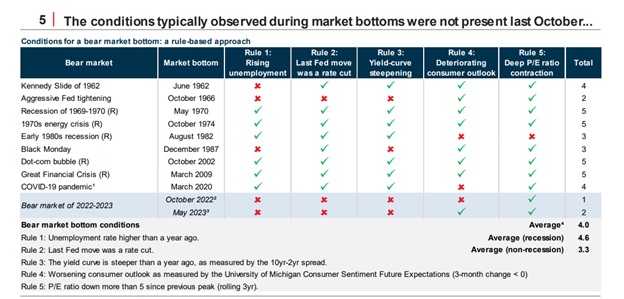

Bear market rally or new bull market: National Bank identifies the “5 rules” to a stock market bottom, only two of which are currently apparent, and only one of which was apparent during the market low of October 2022. This suggests we may be seeing a temporary rebound, rather than the beginning of a new bull market.

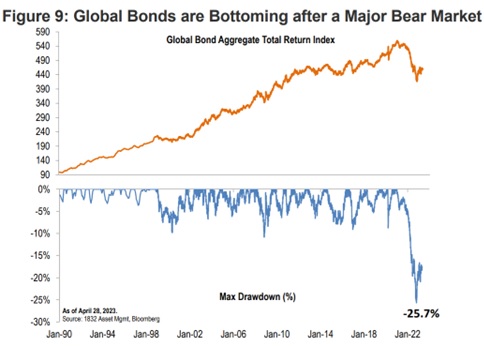

Backdrop is right for fixed-income bias: Global bonds suffered one of their most severe bear markets in history, declining by almost 26% in total return terms from the prior high-water mark set back in early 2021. Since last October, however, the bond market has been climbing in value and is now up by almost 11%. Bond markets have often put up their best performance numbers just before the end of a rate hiking cycle to a few quarters beyond that point. With inflation momentum fading, and economic growth under downward pressure, the global bond market rally seems to have further to run. In any event, bonds are likely to help dampen the volatility of a multi-asset portfolio.

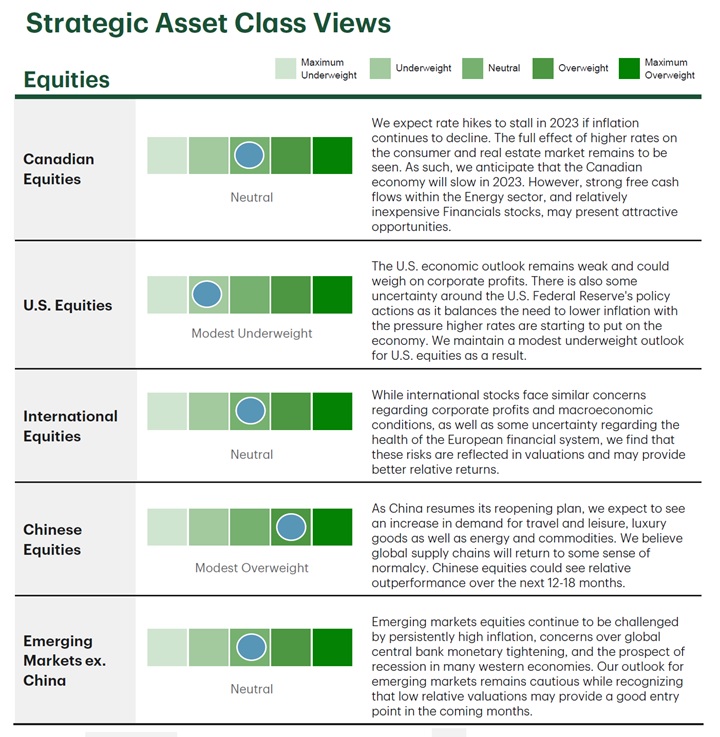

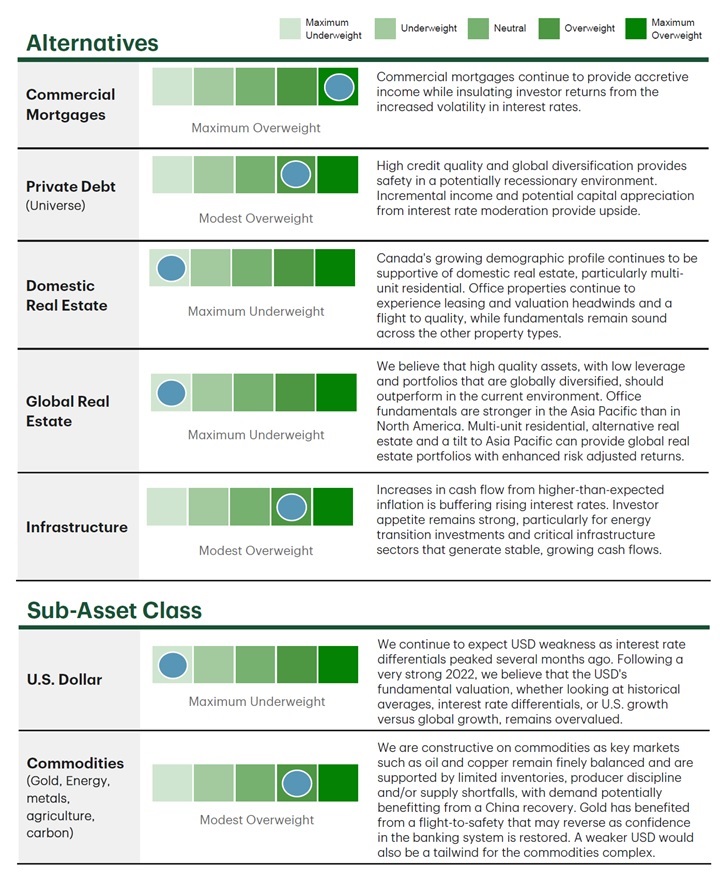

Make tactical adjustments to your asset allocation strategy to reflect the current backdrop: TD Wealth’s Asset Allocation Committee (WAAC) recommends underweight exposure to US equities and overweight exposure to commodities (which are well represented in the Canadian market).

The First-Time Home Savers Account (FHSA) has launched (Investia will have account ready in the summer): The FHSA will likely become the first account prospective home buyers save into. Canadians can contribute up to $8,000 a year to a lifetime limit of $40,000. Contributions are tax-deductible and do not impact RRSP space. Withdrawals for the purpose of buying a first home are tax-free and are not subject to any repayments (unlike the RRSP Homebuyer’s Plan).

We expect our dealership Investia to implement this account structure in the summer.

The return of the savings account: Debtholders are not happy with a higher rate environment, but savers are. The rise in interest rates has resulted in savings rates of more than 4%, which is a better “risk-free” rate than we’ve seen in 15 years. If you have short-term money yielding little to nothing in a chequing account and wish to take advantage of higher rates, please let us know. High-interest investments can be implemented directly in your Investia portfolio and top yielding rates are currently 4.35%.

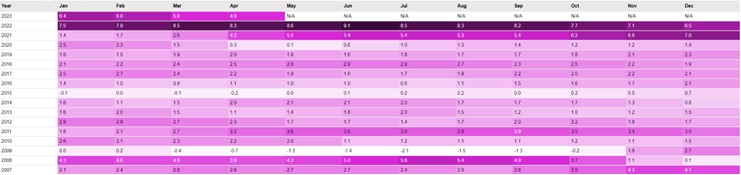

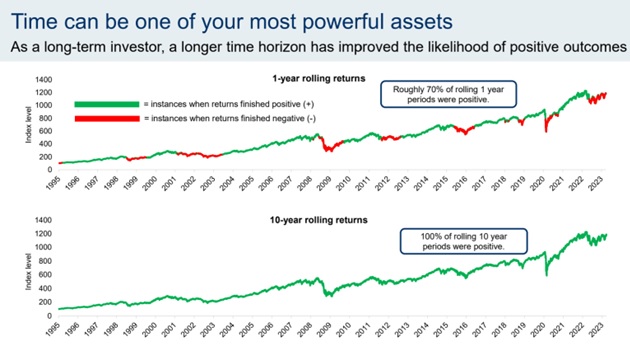

Think long-term: Markets are scary in the short-term, but not in the long-term. The chart below shows that 70% of 1-year periods for the TSX (Canadian market) going back to the mid-90s resulted in a positive return, and 100% of 10-year resulted in a positive return. Similar observations apply for the S&P 500 (US market) going back 100 years.

The probability of a global economic slowdown has risen due to tightening credit conditions, which should lead to decreased spending and lower prices. The rate increases over the last year have a delayed impact so are still gradually impacting the economy and monetary policy decisions. Although markets have shown encouraging performance since Q4 2022, short-term economic headwinds remain, which calls for a defensive portfolio strategy.

Regardless of where we are in the market cycle, it’s important to take a disciplined approach to investing and stay focused on your long-term goals. This strategy helps you keep your emotions out of investing, typically buying high and selling low like many investors do. Ongoing monitoring and reviewing of your portfolio also ensures it remains on track.

We are here to support you in achieving your financial goals. Please do not hesitate to contact us.