“What is drama but life with the dull bits cut out” – Alfred Hitchcock

Drama Is Constant

The Attention Economy is, according to Wikipedia, “an approach to the management of information that treats human attention as a scarce commodity and applies economic theory to solve various information management problems. Put simply by Matthew Crawford, ‘Attention is a resource – a person has only so much of it.’”

This concept of finite attention is a large part of why news headlines have become more and more sensationalized over time. Media and content creators can’t waste time on stories we won’t read, so the drama needs to be escalated to 11 (a little Spinal Tap joke for those of the right vintage). Over time, even the most mundane and routine news can feel more important than it really is, simply because of the headline.

How does this relate to the economy and to stock markets? Well, it’s simple really – Investors are people, and are prone to being carried away by sensationalized market news.

Geoff MacDonald, Portfolio Manager at EdgePoint, summed up this point perfectly:

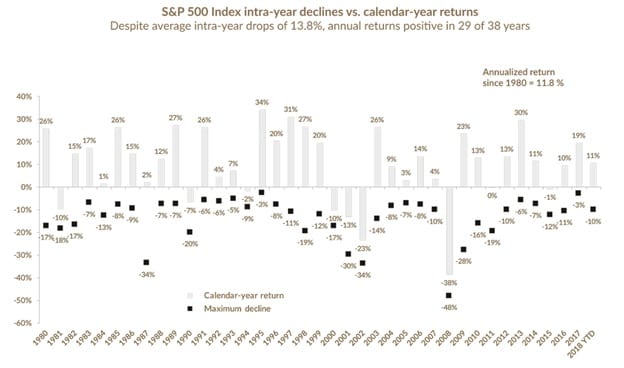

Below is a chart of the S&P 500 Index going back to 1980. It shows annual returns and also shows the annual drawdowns (i.e. how much the stock market went down at some point during the year). Look closely at the drawdowns the market has experienced each and every year. During those drops in each year there was some type of drama. A narrative took hold, fear increased and those who succumbed to the fear would have ended with undesirable results. Note that had an investor simply bought an index proxy in 1980 and held it these past 38 years through all the market drama, they would have made 11.8% per year.

Armed with the fact that the market historically has experienced an average drawdown of 13.8% every year, and that paying a lower price for an investment is better than paying a high price for that same investment, there should be no drama in the head of any strong investor the next time the market moves lower. The drawdowns should be looked at as a constant, something that has taken place every year. Knowing that it happens every year and will happen again next year will make it harder to overreact and easier to act on good investment opportunities.

Weekly Update – By The Numbers

North America

- The TSX closed at 15,470, up 56 points or 0.36% over the past week. YTD the TSX is down -4.56%.

- The DOW closed at 25,444, up 104 points or 0.41% over the past week. YTD the DOW is up 2.93%.

- The S&P 500 closed at 2,768, up 1 point or 0.04% over the past week. YTD the S&P 500 is up 3.52%.

- The NASDAQ closed at 7,449, down -48 points or -0.64% over the past week. YTD the NASDAQ is up 7.91%.

- Gold closed at 1,230, up 14 points or 0.74% over the past week. YTD gold is down -6.11%.

- Oil closed at 69.4, down -1.94 points or -2.72% over the past week. YTD oil is up 14.86%.

- The USD/CAD closed at 0.7635, down -0.0044 points or -0.57% over the past week. YTD the USD/CAD is down -4.00%.

Europe/Asia

- The MSCI closed at 2,062, down -1 point or -0.05% over the past week. YTD the MSCI is down -1.95%.

- The Euro Stoxx 50 closed at 3,211, up 17 points or 0.53% over the past week. YTD the Euro Stoxx 50 is down -8.36%.

- The FTSE closed at 7,050, up 54 points or 0.77% over the past week. YTD the FTSE is down -8.30%.

- The CAC closed at 5,085, down -11 points or -0.22% over the past week. YTD the CAC is down -4.29%.

- DAX closed at 11,554, up 30 points or 0.26% over the past week. YTD DAX is down -10.56%.

- Nikkei closed at 22,532, up 261 points or 1.17% over the past week. YTD Nikkei is down -1.02%.

- The Shanghai closed at 2,551, down -56 points or -2.15% over the past week. YTD the Shanghai is down -22.86%.

Fixed Income

- The 10-Yr Bond Yield closed at 3.20, up 0.06 points or 1.91% over the past week. YTD the 10-Yr Bond is up 33.33%.

Sources: EdgePoint, Yahoo! Finance, Dynamic, Wikipedia

This information is provided for general information purposes only. It does not constitute professional advice. Please contact a professional about your specific needs before taking any action.