The 2019 Federal Budget tabled several proposals that will impact the financial, tax and estate plans of Canadians. The following is a summary of the most relevant budget proposals that may impact You First clients:

Measures for Individuals

Home Buyers’ Plan Withdrawal Limit Increase

The home buyers’ plan (HBP) allows first-time home buyers to withdraw up to $25,000 from a registered retirement savings plan (RRSP) to purchase or build a home without having to pay tax on the withdrawal.

Budget 2019 proposes to increase the HBP withdrawal limit to $35,000 from $25,000. As a result, a couple will potentially be able to withdraw up to $70,000 from their RRSPs to purchase a first home. This increase will apply to the 2019 and subsequent calendar years.

Also, the “first-time home owner” condition is removed for individuals that separate and live apart due to a breakdown of a marriage or common-law relationship.

Stock Option Limitations

The government is proposing to limit the capital gains deduction for employees of large, long-established, mature firms to $200,000 per year based on the fair market value of the underlying shares. The government has proposed limits to stock option benefits. Currently, it is possible for employees to pay tax at capital gains rates on employment stock options when certain conditions apply.

Canada Training Credit

Effective for 2019 and subsequent taxation years, the budget proposes to introduce the Canada Training Credit, a refundable tax credit to assist working Canadians with the cost of professional development. The credit is the lesser of eligible tuition and a new notional account. Eligible individuals will accumulate $250 each taxation year in a notional account.

To be eligible individuals must:

- file a tax return for the year;

- be at least 25 years old and less than 65 years old at the end of the year;

- be a resident in Canada throughout the taxation year;

- have net income under the third federal bracket $147,667 (for 2019)

The lifetime maximum is $5,000, which expires the year an individual turns 65 years of age. The federal tuition 15 per cent non-refundable tax credit will still be available on the difference between the eligible tuition fees and the refundable Canada Training Credit.

EI Training Support Benefit

This benefit is expected to be launched in late 2020. It will be available through the EI program and will provide up to four weeks of income support, every four years. This support will be paid at 55% of a person’s average weekly earnings and is designed to help workers cover living expenses while on training.

Digital News Subscriptions

A new non-refundable tax credit of up to $500 for subscriptions paid in a year to a qualifying Canadian journalist organization – a tax savings of $75 per year. This credit is available for the years after 2019 and before 2025.

Registered Disability Savings Plan – Cessation of Eligibility for the Disability Tax Credit

The 2019 Federal Budget proposes to eliminate the medical certification requirement including the requirement to close the account when the individual loses the disability tax credit. This will help retain the grants and bonds in the account that would under the current rules be required repaid to the Government. In addition, a tax-deferred rollover of a deceased parent or grandparent’s registered retirement account (RRSP/RRIF) will be permitted until the end of the fifth calendar year following the loss of the DTC which is not allowed under the current rules.

The 2019 Federal budget also proposes to creditor protect RDSP’s from seizure in bankruptcy, except contributions made 12 months prior to filing.

If an RDSP beneficiary becomes DTC ineligible the issuer will not be required to close the account on or after March 20, 2019.

First-Time Home Buyer Incentive

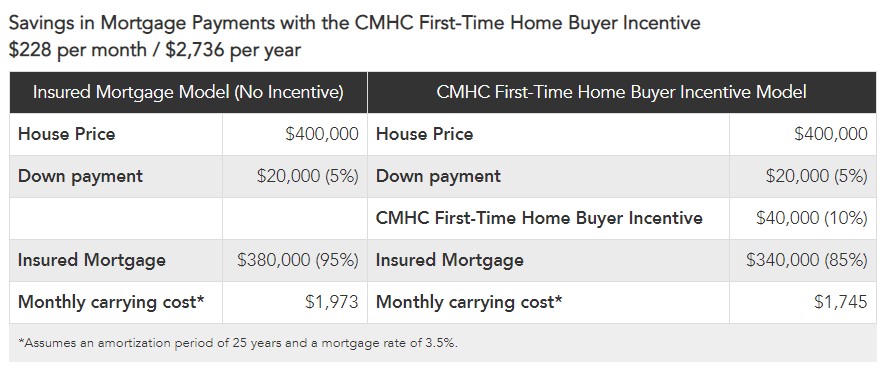

The federal government’s major housing announcement is a $1.25-billion, three-year program of zero-interest loans for low- and middle-income people looking to buy their first home. The incentive is subject to various conditions, including that buyers have a household income below $120,000 a year. CMHC will release full details later this year, with the loans available in September, pending passage of legislation.

Eligible first-time home buyers could finance part of their purchase through a shared-equity mortgage with CMHC. The incentive is for insured buyers – those who make a down payment of less than 20 per cent. It would reduce a buyer’s total borrowing costs and therefore their monthly mortgage payments.

The budget offered an example of how the incentive would work. For a $400,000 home purchase, an insured buyer must have 5 per cent (or $20,000) for the down payment. For a new home, a shared-equity mortgage would offer $40,000, lowering the total borrowing costs to $340,000 from $380,000. The incentive would be repaid when the home is sold.

Source: Federal Budget 2019

Improved Rental Options

To provide more affordable rental options for middle-class Canadians, Budget 2019 proposes to provide an additional $10 Billion over nine years in financing through the Rental Construction Financing Initiative, extending the program until 2027–2028.

Automatic CPP Enrolment at Age 70

According to the government, approximately 40,000 people 70 or older are currently not enrolled in the Canada Pension Plan, meaning they aren’t receiving a monthly retirement pension (the budget calculates that this would be $302 a month on average in 2020). The budget is proposing to proactively enroll eligible seniors at age 70 so they don’t miss out on their CPP benefits.

Guaranteed Income Supplement Threshold

The government is also proposing an increase to the guaranteed income supplement (GIS) earnings exemption for low-income seniors, from $3,500 to $5,000. In practice, this means seniors receiving the GIS will be able to exempt $1,500 more in income each year before clawbacks.

Measures for Corporations

Enhanced Zero-Emission Vehicle Depreciation

For vehicles purchased by a corporation for use in business activities, there is a 100% write-off of the cost (to a maximum of $55,000) in the year of acquisition. This treatment is available for purchases between March 19, 2019 and January 1, 2024. A significant increase in the write-off compared to the typical 30% which was capped at a cost of $30,000.

EI Training

Budget 2019 proposes to introduce an EI Small Business Premium Rebate. Starting in 2020, any business that pays employer EI premiums equal to or less than $20,000 per year, would be eligible for a rebate to offset the upward pressure on EI premiums resulting from the introduction of the new EI Training Support Benefit.

Increased Support for Canada Revenue Agency

The budget announced increased funding for CRA including:

-An additional $150.8 million to combat tax evasion and aggressive tax avoidance through hiring additional auditors, creating a new data quality examination team to ensure proper withholding, remitting and reporting of income earned by non-residents, and extending programs aimed at offshore non-compliance.

– An additional $50 million over five years, starting in 2019–2020, to create four new dedicated residential and commercial real estate audit teams in high-risk regions, notably in British Columbia and Ontario, to ensure that tax provisions regarding real estate are being followed, with a focus on ensuring that:

- Taxpayers report all sales of their principal residence on their tax returns;

- Any capital gain derived from a real estate sale, where the principal residence tax exemption does not apply, is identified as taxable;

- Money made on real estate flipping is reported as income;

- Commissions earned are reported as taxable income; and

- For Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes, builders of new residential properties remit the appropriate amount of tax to the CRA.