Today, U.S. Consumer Price Inflation (CPI) data was released, and there was a slight dip reported. What does it mean? We would like to provide some context, courtesy of Dynamic Funds’ Chief Investment Strategist, Myles Zyblock.

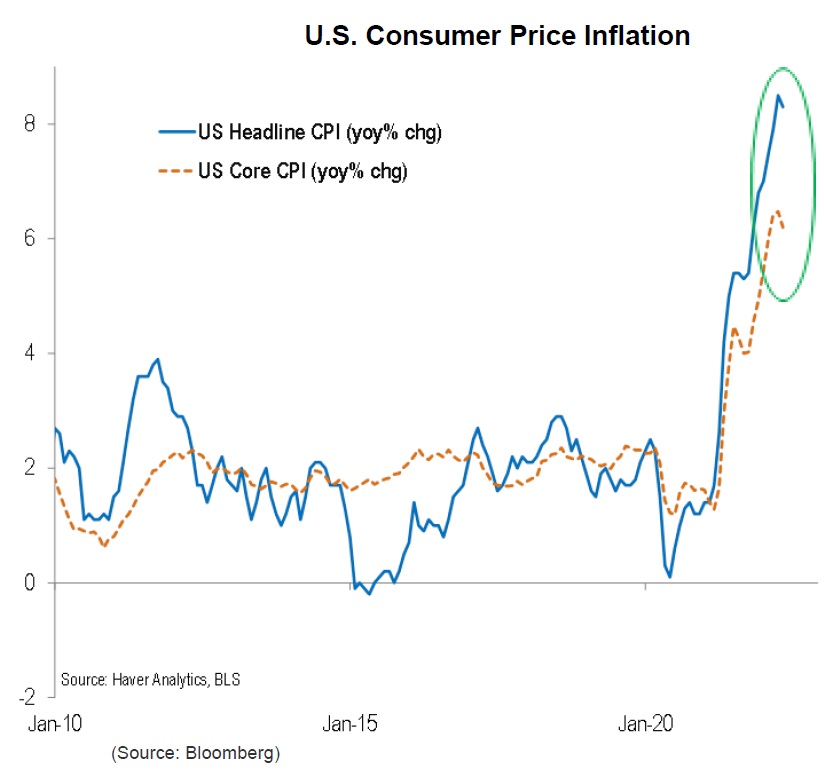

U.S. CPI data was released earlier today. This was one of the most closely watched CPI numbers I can remember in my career given that high and accelerating inflation has been a major force behind the Fed’s aggressive tightening message and its related knock on affects through to asset price valuations. The headline CPI came in at 8.3% y-o-y, a slight moderation from the prior month’s 8.5% reading. The core CPI inflation rate dipped to 6.2% from 6.5%. While these still represent very elevated inflation readings, they might also offer the first sign of a turn for the better.

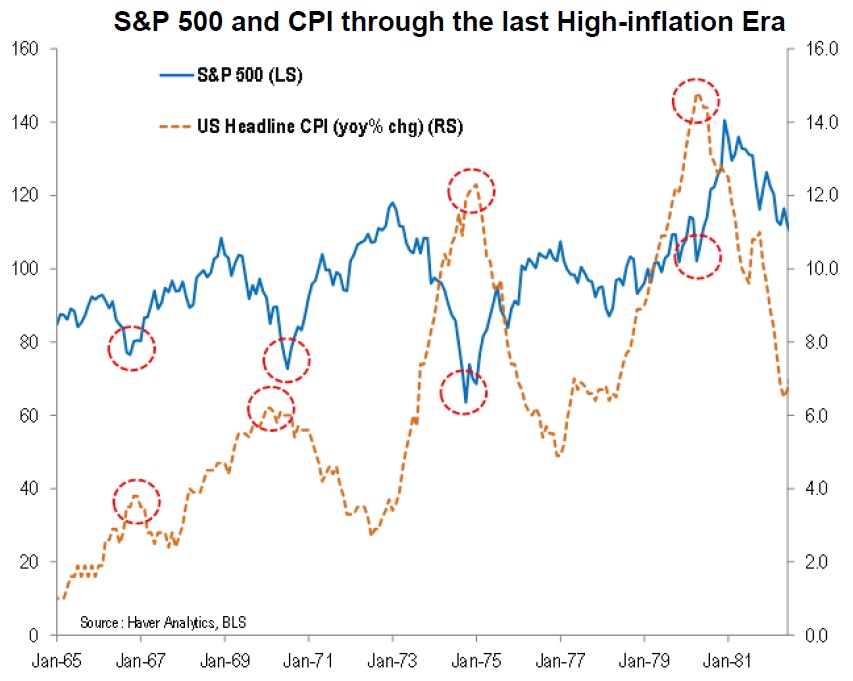

It is difficult to know how the financial markets will absorb this latest data over the immediate days and weeks ahead. Investors are skittish after the near 17% drop in the S&P 500 and 19% drawdown in 10-year government bonds. But, looking back to the 1970s we can gain some insight into how things might play out over coming months if peak inflationary pressure is now standing in the rear-view mirror. Each and every local turn lower in CPI inflation was met by a rally in stock prices. Bonds rallied similarly. Historically speaking, it was not so much the level of inflation that mattered for the markets as much as it was the direction of inflation. Inflation rolling over, even from a high level, was usually good news for stocks and bonds during the last major era of problematic inflation.

(End of Myles Zyblock Commentary)

As always, we encourage you to reach out to us with any questions you may have.

Sources: Dynamic Funds