The effect of central banks and monetary policy on equity and fixed-income (and real estate, and cryptocurrency) markets cannot be understated at the moment. An average daily market recap will contain terms like Federal Reserve, Quantitative Easing, Stimulus, Tapering, Interest Rates, and Inflation to explain market activity. In this article we breakdown these terms and their impact on markets.

What is monetary policy? Monetary policy is a set of tools that a nation’s central bank has available to promote sustainable economic growth by controlling the overall supply of money that is available to the nation’s banks, its consumers, and its businesses.

The two most common methods central banks use to influence an economy are the changing of interest rates and quantitative easing.

What do central banks do to stimulate or cool down (taper) an economy? If a central bank, like the Bank of Canada (BoC), sees that the economy needs a boost to meet their inflation target (2%), they can lower their policy interest rate to encourage borrowing and spending.

Changing the policy interest rate directly affects very short-term interest rates on products like loans, lines of credit, and mortgages. In the case of a rate decrease, those bills become less expensive, and households are left with more disposable income. When consumers have more discretionary spending money, businesses’ revenues, and profits increase, which positively impacts earnings and stock prices.

Tapering is the opposite of stimulus and describes the reversal of a central bank’s stimulus measures. If the BoC sees that the economy needs to be slowed down to meet their inflation target, they can increase their policy interest rate to discourage borrowing and spending.

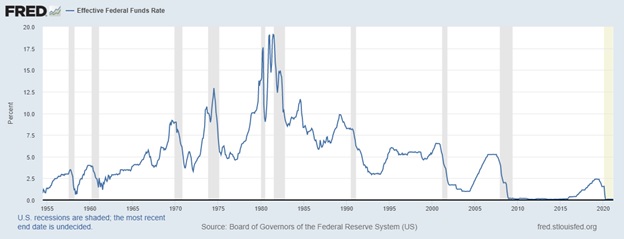

The chart below shows the U.S. Federal Reserve rate since 1955. The Bank of Canada has generally followed the Fed’s policy making. As you can see, we’ve been in a 30-year declining rate cycle, and current rates are at historical lows:

What is quantitative easing (QE)? QE is another method in which central banks can execute monetary policy. Under QE, a central bank buys government bonds. Buying government bonds raises their price and lowers their return—the rate of interest they pay to bondholders – also known as the bond’s yield. Fifteen years ago, one could hold a 10-year government of Canada or US bond and receive a 4% yield. Today, that same government bond is yielding approximately 1.5%.

Government bond yields have a big influence on other borrowing rates. Lower yields make it cheaper to borrow money. So, QE encourages households and businesses to borrow, spend and invest.

How do interest rates impact the stock market? In the case of a rate increase, if a company is less profitable, either via higher debt costs or less revenue— the projected amount of future cash flows will drop. All else being equal, this will lower the price of the company’s stock.

However, some sectors benefit from interest rate hikes. One sector that tends to benefit the most is the financial industry. Banks, brokerages, mortgage companies, and insurance companies’ earnings often increase—as interest rates move higher—because they can charge more for lending.

The lowering of interest rates and implementing of quantitative easing by central banks in March 2020 played a big role in reversing the stock market’s negative reaction to the start of the pandemic last year.

How do interest rates impact the bond market? There is an inverse relationship between bond prices and interest rates: when interest rates rise, bond prices fall (and vice versa). The longer the maturity of the bond, the more it fluctuates in accordance to changes in the interest rate.

When a central bank increases interest rates, newly offered government securities like bonds will usually experience a corresponding increase in interest rates. Conversely, when interest rates fall, it becomes easier for entities to borrow money, resulting in lower-yielding debt issuances. Simultaneously, market demand for existing, higher-coupon bonds will increase (causing their prices to rise and yields to fall).

What is inflation and why does it matter to markets? Inflation is the decline of purchasing power of a given currency over time which, consequently, leads to a rise in the general level of prices for goods and services. This loss of purchasing power impacts the general cost of living for the public which ultimately leads to a deceleration in economic growth. The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth.

Current monetary policy has resulted in a large increase in the “printing of money” or money supply. Note that the term “printing of money” is usually stated metaphorically. Governments and central banks rarely ever print and distribute physical money to influence the money supply, instead relying on the tools described earlier, such as changing interest rates for interbank lending, or QE programs.

The concern is that this historically unprecedented injection of money into the system will lead to inflation in the short, medium, or long-term, thus forcing central banks to raise rates and lead to short-term negative effects for equity or fixed-income markets described above.

Monetary policy will likely continue to influence markets for years to come, but a well-diversified portfolio can address interest rate or inflation risk. Companies that have pricing power are better equipped to handle inflation. This year’s outperformance of the commodities-heavy Canadian market is part due to the inflation backdrop. Having bias towards corporate over government bonds in the fixed-income portion of the portfolio is another way to address interest-rate risk. Frank’s article “The Fixed Income Dilemma” discusses various way you can “risk-up or down” from the fixed-income portion of your portfolio.